The Colpatria Rentapremium account is arguably the best savings account in Colombia. The savings account pays a decent interest rate, which is higher than the other banks in Colombia and is much higher than savings account interest rates in the US.

The Rentapremium account also has no fees unlike savings accounts from many other banks in Colombia that have fees.

Colombia in many ways is still a cash-based economy. You can use cash to pay bills and nearly one-third of Colombians don’t even have a bank account.

According to Bancolombia in 2015 only 5% of adult Colombians had a checking account, only 3% had a mortgage, only 21% had a credit card and 68% had a savings account.

I lived for over four years in Colombia without a bank account in the country. Before opening an account I simply used my ATM cards, credit cards and cash. But last year with the improved Colombian exchange rate I finally decided to open a savings account.

I spent some time researching the savings accounts offered by the banks in Colombia and discovered the Colpatria Rentapremium account, which I believe is possibly the best savings account in the country.

The Colpatria Rentapremium Account

One of the biggest benefits of the Colpatria Rentapremium account is that it pays a decent interest rate of 2.6% annually for a balance above 5 million pesos but less than 50 million pesos. Above 50 million pesos it pays 3.2% and even higher for above 100 million pesos.

This compares to lower savings account interest rates at several of the largest banks in Colombia.

For example the interest rate for a savings account with a balance of 6 million pesos currently receives an annual interest rate of 1.0% at BBVA, 1.3%% at Banco de Bogotá, 2.0% at Bancolombia and 2.0% at Banco de Occidente.

In comparison the average interest rate in May for savings accounts in the US was a pitiful 0.06% according to the FDIC.

The Colpatria Rentapremium account also comes with a Visa debit card. Colpatria eliminated all fees with its savings accounts, so you can withdraw funds at a teller or by using the debit card at Colpatria ATM machines without paying any fees.

Most of the savings accounts from the other banks in Colombia have a number of fees including ATM fees and branch withdrawal fees.

With the Rentapremium account I can recharge cellphones online and also pay bills online like my EPM utility bill. I can also receive wire transfers from my accounts in the US.

So I can transfer money to Colombia with an exchange rate that is close to the rate on xe.com and use my Colpatria debit card to withdraw funds from Colpatria ATM machines with no fees.

Colpatria is reportedly the fifth or sixth largest bank in Colombia. Colpatria is majority owned by Scotiabank in Canada.

Colpatria has over 180 bank branches and over 1,000 ATM machines in Colombia. You can find Colpatria ATM machines in most shopping malls in the country.

Opening a Bank Account in Colombia

What did it take to open a Rentapremium savings account at Colpatria?

- My original Colombian cédula de extranjería ID and copy of the front/back

- Copy of my Colombian tax return (Declaración de Renta) showing my income as they wanted to verify a minimum income to open the account

- Manually filling out an application form with address in Colombia and phone numbers

- Answering questions about my job and how long I have lived in Colombia but I did not have to provide proof

I also have CDT accounts at two other banks in Colombia. In both cases I just needed my cédula de extranjería and an application to open the accounts. In no cases in opening accounts at three different banks in Colombia did I need to show my US passport.

I have seen some posts on the Internet claiming you can open a bank account in Colombia with just a passport. While this may be possible with connections, every bank I talked to in Colombia said they would not open a bank account with just a passport, they all said a cédula is required.

Not all bank branches in Colombia are experienced in opening accounts for foreigners. You are less likely to encounter problems if you go to a bank branch in an area with more foreigners like El Poblado in Medellín

When I opened my Colpatria account at a small local branch away from El Poblado they originally said I couldn’t but I insisted and they called the main office and determined they could open an account for a foreigner.

CDTs in Colombia Pay High Interest Rates

A CDT in Colombia is basically equivalent to a CD in US. The banks in Colombia currently pay much higher interest rates for CDTs in Colombia than you can get with CDs in the US.

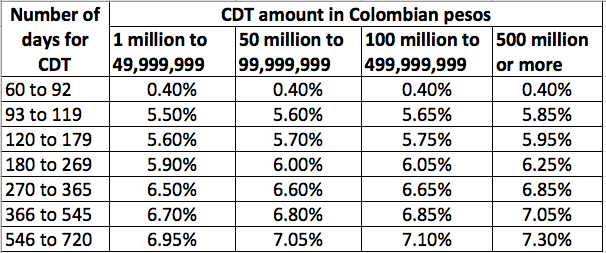

The interest rates paid by banks for CDTs in Colombia depend on the balance, with somewhat higher interest rates typically being offered for higher balances. For example, here are the CDT interest rates currently being offered by Colpatria:

It is possible to find some CDT rates higher than 8% in Colombia but this will normally require a high balance. For example the Banco de Occidente 540-day CDT for 100-499 million pesos currently has an 8.2% interest rate. Most CDTs in Colombia with lower balances currently pay between 5-7% annually.

In comparison in the US 1-year CDs currently pay an average interest rate of only 0.22% according to the FDIC. The highest interest rate offered in the US for 1-year CD currently is 1.25% according to Bankrate.

The CDT interest rates being offered by banks in Colombia can fluctuate. That’s why I now have CDTs at three banks. I opened CDT accounts with the major bank that was offering the highest interest rate at the time. I recommend checking CDT rates at several banks as they will vary.

My plan in opening CDTs is to transfer money to Colombia when the exchange rate is higher and put the money in CDTs earning interest that is much higher than the interest paid in the US. This essentially locks in an average higher exchange rate.

Don’t Forget FBAR and FACTA

A US taxpayer must file an FBAR (Foreign Bank and Financial Accounts) report annually in the US if the aggregate of your foreign accounts exceeds $10,000 at any time during the year.

FATCA, which foreign banks have to deal with, has much higher reporting thresholds, which vary based on whether you file a joint tax return or live abroad. The full FACTA reporting requirements from the IRS can be found here.

Also US taxpayers keep in mind that interest earned on foreign bank accounts must be declared on your US tax return.

The Bottom Line

The biggest challenge in opening a bank account in Colombia is that all six banks I talked to said that a cédula is required. So you need a visa before opening a bank account as you can’t receive a cédula without a visa.

Opening a Colpatrica Rentapremium account has benefits in my experience. The account offers a decent interest rate. With the account I can wire transfer funds from another country and access these funds in Colombia without fees.

I can also recharge my cellphone online from home and also pay some bills online avoiding the need to stand in lines to recharge cellphones or pay bills.

CDTs in Colombia are also worthwhile as they pay much higher interest rates than CDs in the US.

Do you have any experience with Alianza? I was told that if you set up an account with them you can wire transfer dollars to your account. They will pay market currency exchange rate and charge about 1/2 percent commission. How does that compare with the exchange rate you are getting?

I have an escrow with Alianza on the condo I bought in Medellin(builder uses them, not my choice). The customer service is so so.

Alianza Valores is a brokerage firm, not a bank, and I don’t believe their brokerage accounts come with a debit card.

I don’t have experience with Alianza Valores but I know a number of foreigners have used them when bringing money into the country to buy properties. The exchange rate I received with wire transfers at Colpatria was close to the market rate on the day of the transfer. Reportedly Colpatria is competitive with other banks in Colombia like Bancolombia for wire transfers. Colpatria’s claim for international wire transfers is “we have the most competitive rates in the market”.

Thanks Jeff; very informative article!

Great article

Jeff,how is the customer service for Colpatria(phone and in person)? Bancolombia and Davivienda customer service is terrible.

thanks

Mike

Customer service at Colpatria has been good in my experience. Some of the staff in the local branch now know me and greet me when I come in and they have been helpful and knowledgeable when I had questions about things like wire transfers and CDTs. The lines in branches are nowhere near as long as you will find at Bancolombia.

I use Colpatria’s online services and haven’t experienced a problem so I haven’t needed to call yet so I can’t comment on phone support.

Thank you very much Jeff for this very informative article. I will definitely use it.

A question: does one also need a cédula de extranjería in order to open a CHECKING account?

A cédula de extranjería (for foreigners) or cédula de ciudadanía (for Colombian citizens) is required to open any account at Colpatria or the other banks in Colombia.

By any chance would you know what Colpatria’s ATM cash dispensing limits are?

Thanks

I believe the limit per ATM transaction is 600,000 pesos but you can do more than one ATM transaction. I’ve done two without a problem.

In Commercial Santafé and Oviedo the limit is 2 million at once (in one single withdrawal)

Great article – thanks! In Canada, anyone can open accounts in Canadian dollars or US dollars or both in any of major banks. At least one large bank offers savings account in Euro. Do banks in Colombia offer accounts in foreign currencies?

Not to my knowledge do any of the banks in Colombia offer accounts in foreign currencies. There’s not really that many foreigners living in Colombia so probably not much demand for such a service.

Thanks for the article, Jeff.

Do you have any experience transferring money from a Colombian bank to a US account? I’ll be leaving the country soon and need to transfer my pesos either to USD to carry with me (not ideal) or do a wire transfer (hopefully without losing too much in fees).

Sorry, no I don’t have experience transferring money from a Colombian bank to a US account since I live in Colombia full time. But I suspect you would likely get a better exchange rate with a wire transfer compared to exchanging the money here in Colombia using cash – pesos to USD. I recommend stopping by one of the bank branches to ask.

Hi Jeff, Very good article about the banks. One question I have is the government of Colombia insure the bank accounts up to a certain amount, like the FDIC does here in the USA? thanks.

Regards,

Monte

Hi Monte,

I am not aware of there being something like FDIC in Colombia. But I wouldn’t put much faith in FDIC in the US during a banking crisis with the small reserve they have.

I would recommend using one of the largest banks in Colombia – not one of the small ones. I understand the six largest banks in Colombia are Bancolombia, Banco de Bogotá, Davivienda, BBVA, Banco de Occidente and Colpatria. You’ll find branches of each of these banks in all the major cities in Colombia.

Bancolombia is the largest bank in Colombia and the company is publicly traded in the US and Colombia. I know many expats use Bancolombia but I personally wouldn’t recommend Bancolombia as they charge fees plus have lower interest rates than other banks. BBVA is another large multinational bank that is publicly traded. Colpatria is reportedly the fifth or sixth largest bank in Colombia plus they are majority owned by Scotiabank, which is the third largest bank in Canada that is publicly traded, to me this makes them safe.

Hi Jeff . Great article but i went to a Colpatria today + she told me i have to wait 6 months after opening one to transfer money from outside of Colombia .

Interesting. They didn’t tell me when I opened my Colpatria account the need to wait 6 months to transfer money from outside Colombia. But I didn’t ask about wire transfers when I opened the account as I wasn’t planning to do one until later.

Several months after opening my account I talked to the branch manager about the process to do a wire transfer and the manager never told that I needed to have the account open 6 months. I checked online and I did my first wire transfer after having my account open for 5 months.

Comparing the interest rates without comparing the inflation rates is a bit unfair.

Colombia inflation rate is projected at 6% to 8% in the next five years. In the USA the Feds are having trouble getting the inflation rate above 1% – the target is 2%.

The issue of exchange rates is another hairball.

Colombia’s inflation rate is not projected to be 6 to 8 percent in the next five years. Colombia’s inflation is expected to come down to within the central bank’s 2 to 4 percent target range by the end of next year. See: http://www.reuters.com/article/colombia-cenbank-idUSL2N18317Y.

Also I haven’t seen any impact of the current higher inflation. I just negotiated to renew my rental lease at a lower price than I paid last year. Our grocery bills have dropped as we started shopping at lower cost alternatives to Exito. See: http://medellinliving.com/inflation-2015/. Our current living costs in terms of pesos have actually dropped compared to the past few years.

The exchange rate works both ways. For example I exchanged money when the exchange rate was over 3,400 pesos to the USD and put this money in a CDT earning over 7%, which I intend to use when I renew my apartment lease next year – this locks in my rent price in terms of USD. The exchange rate is currently 3,052 pesos to the USD and may not get back above 3,400. The exchange rate fluctuates but I do wire transfers when the exchange rate is higher so my exchange rate on average is higher than the actual average. Over the past six months the average exchange rate was 3,139 pesos but my average exchange was over 3,300 pesos.

Bancolombia in our experience (where we have a savings account) pays a greatly discounted rate on foreign exchange of US dollars. For example, if the published rate is 3,300 COP per USD, they only give us 2,800 COP per USD. Also, it takes up to a month to get our money when using wire transfers from our US bank account, even when we purposely stay under the $5,000 “ceiling” for triggering inquiries. It’s a pain.

Taking up to a month for a wire transfer is ridiculous IMHO. Also that foreign exchange rate is also ridiculous. Bancolombia is the biggest bank in Colombia but IMHO other banks like Colpatria offer better rates and better services.

Jeff,I am assuming you live based on the USD as I will when I move to Medellin. Since we get USD everything looks different from our point of view. From the colombian side the economy is stagnet,most products have gone up in prices and Colombia has one of the lowest min. wage in South America. President Santos approval rating is as low(economy and the way he is handaling the FARC) as Maduro. My wife son interviewed for a job at a high end hotel in Poblado,pay 689,000/month. 689,000/3000. $229/month.

Keep up the good work,your blogs are very informative,would love to buy you a drink on my next vist to Medellin.

Hi Mike,

Thanks. Yes I live based on the USD since my salary is in USD. But I do track prices of everything in Colombian pesos since nothing is priced in dollars. Our cost of living in terms of Colombian pesos for a couple over the past two years has actually decreased by about 17% so we haven’t seen impacts of inflation. I haven’t seen prices for several things increase – for example the price for our rent, taxis and triple-play Internet/phone/TV haven’t increased.

It is possible to adjust your shopping behaviors to avoid experiencing much inflation in terms of pesos in Colombia, just as you can do in other countries. The biggest price increase in terms of pesos have been for imported items but you can buy locally produced items. But if your income is in dollars you really don’t see the impact of inflation in terms of USD because of the improved exchange rate compared to a few years ago.

Yes most wages are low in Colombia that’s why families tend to have more than one income to survive.

Hi Jeff its great to read your blogs.

I’m from the USA and now reside in Medellin.

Do you reside in Medellin

Yes, I reside in Medellín full-time.

Hi Jeff, my friend just contacted Helm Bank here in Cali and confirmed with them that they do NOT have the 6-month wait restriction on receiving foreign funds. They told him you can open an account and receive foreign funds immediately.

I asked at my local Colpatria branch and the assessor who opens accounts and the branch manager both didn’t knew anything about a 6-month wait restriction at Colpatria for foreign wire transfers. Plus I was definitely able to do a wire transfer from the US less than 6-months after opening my account.

From my experience with davivienda and bancolombia -do not know with colpatria, make sure the account is set up to receive foreign wire transfer( just need to do it once). If not money will not go in.

Great news letter and informative. I am planning in buying property in Medellin at some point and have been going there since 2008 from United States. Never needed a visa to get there. Do I did to apply for a visa here in Arizona at a certain agency. I will try to get my cedula when I get there next week and open up an account at Colpatria.

You can apply for a Colombian visa at a Colombian consulate. The one serving Arizona is located in Los Angeles at 8383 Wilshire Boulevard, Suite 420, Beverly Hills, CA 90211. It’s open from 9:00 am – 2:00 pm. Or you can apply for a visa in Colombia. You can find a list of the Colombia visa options on the Cancillería website.

Thanks Jeff for the information,

I am in Medellin as of Last week Thursday and will be returning Sunday. I used the Cacilleria website to apply for a visa and find that there are many types of visas. Since I am only trying to get a cedulla to open a savings account at Colpatria to someday buy property someday. Should I be looking for a temporary visa and what type because there are about 12 types.

Anyway,Life is great here as usual. Hope all is well with you.

The best visa depends on your personal situation. See this, which looks at the most common visas: http://www.firstamericanrealtymedellin.com/colombian-visa-best/.

If you are planning an investment make sure you research the proper way to bring the money into the country with the proper paperwork.

I have no Cedula. Just a passport. I do have an account with Ultraserfinco, another brokerage style account similar to Allianza already mentioned. No debit card, but I can get checks payable to individuals or businesses, or request a transfer if I have banking information. Originally opened to facilitate a real estate purchase. I just went through a couple of recent statements, they have been paying 4.5% to 6% on a 3-6,000,000 COP balance.

I was able to wire significant funds a couple days after this account was established, at a good exchange rate to get the real estate deal completed. However I did get a notice 3-4 months ago that international wire transfers were temporarily suspended. I don’t know if this is now resolved or not. Can probably find out…

Service has been good for this expat so far. Contact info is on this site under Ultrabursatilies before the name change to Ultraserfinco.

Hi Bob. Is/was your money invested or just parked in the brokerage account? Whar fees did you pay? Commission based or flat fee (of what percentage rate?) Thanks.

Just FYI, the ‘cuenta rentable’ of davivienda pays 4.4% EA for 2million-50million pesos and higher interest for higher ammounts. They do have a minimum balance of 2 million pesos though.