Ever since 2008 it seems everyone is a bubble watcher. I think it’s a good thing because it keeps markets in check and forces us to ask ourselves if our investments in real estate are justified by the prices we pay. At Casacol we get the question pretty much every day, “do you think there’s risk of a bubble in Medellin real estate?” And every time I’m asked the question I have to stop and ask myself the following:

1) Are banks lending recklessly in Colombia at low interest rates or to unqualified buyers?

2) Are people panic buying for fear of “missing out” (speculative) or due to contagious market hype?

3) Is the intrinsic value of Medellin real estate eclipsed by current prices? (Low or negative ROIs)

4) Is there a market inbalance between supply and demand?

These conditions are more or less which led rise to the US real estate bubble and to real estate bubbles generally speaking. So let’s review and debate each of the three items above to detect if there may be a real estate bubble in fact brewing here in Medellin.

Colombian Banks/Lending Practices

One of the most frustrating experiences any foreigner can have in Colombia is at a local bank. Can I have a bank account? No. Can I transfer some money? No. Can I have a mortgage? No. The reality is that the banks here are hyper conservative and most of this stems from the Colombian economic crisis of 98-99 which affected a lot of emerging markets at the time.

Leading up to the crisis, Colombian banks acted a lot like American banks of 2000-2008. Little documentation, little proof of ability to support the requested debt load, down payments as low as 5%. Then came an economic/banking crisis and the subsequent residential housing law of 1999 (Spanish here). What did the law instate?

– Minimum down payments of 30% (social housing, 20%) of purchase price

– Maximum monthly debt service of 30% of declared and verified income

– Maximum ammortization period of 30 years

– No prepayment penalties of any kind at any time

Combine this with typical mortgage interest rates of central bank rate (currently 4.5%) + 6.0%-7.5% = 10.5-12.0% for GOOD credit and you can see that it is not that easy or cheap for Colombians to get mortgages in their own country, let alone a foreigner.

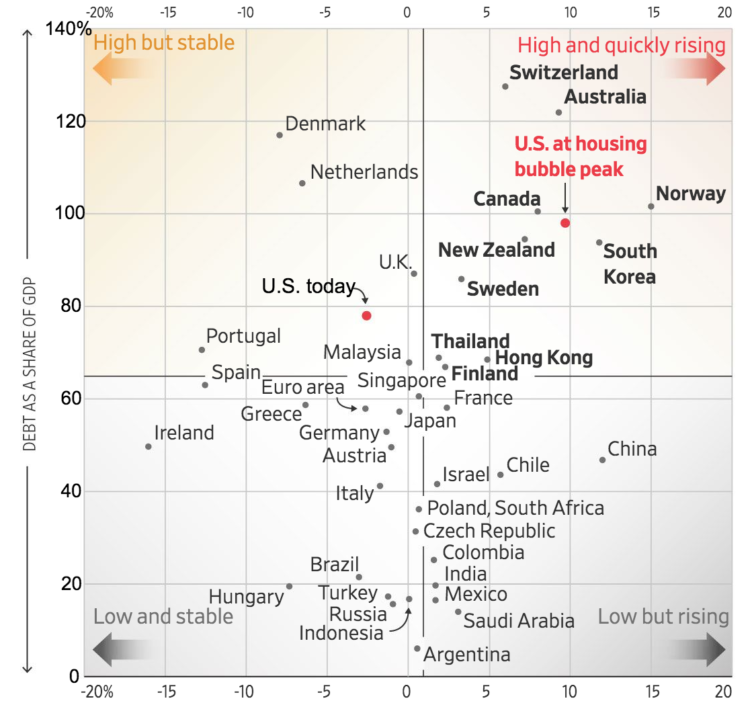

Here’s a recent WSJ article and graphic that pegs Colombia as one of the lowest debt/GDP countries in the World.

Hype/Panic/Speculative Buying

While, I’m generally bullish about the market here, I don’t get excited by the amount of development taking place in the outer areas of Medellin. The fact is that middle class Colombians are buying a tremendous amount of new real estate. It is probably largely warranted and necessary due to the nature of an emerging market: young people need new housing stock.

But if speculative buyers with the desire to flip their contracts to future buyers start to outnumber genuine residents then we could start to have some problems. Either way there doesn’t exist good data to know how high the % of speculative buyers in pre-construction, middle class housing developments really is. But for the moment, this segment is doing a large percentage of the volume in the overall Medellin housing market and bringing in lots of first time homebuyers and investors/speculators along with them.

Are prices in general getting ahead of themselves?

Every real estate market is somewhat unique in that lots of factors can determine the real value of the asset. Manhattan, London or Vancouver real estate can cost 10-20x (or more) vs. comparable high-end square feet/meters in Poblado, Medellin yet there continue to be both large and sophisticated local and overseas investors who don’t blink an eye at current price levels. Those are markets where it’s hard to eek out a 1-2% return on your cash let alone double digits which is common enough here in Medellin.

Having said that, as the market here in Medellin continues to appreciate at 8-10% in 2017 over 2016, the underlying rents are only appreciating at about half of that (closely linked to inflation). This will reduce returns to newcomers to the market and if the trend continues for 5-10 years we could start seeing Medellin prices and rental yields look a lot more like a developed country.

Supply and demand

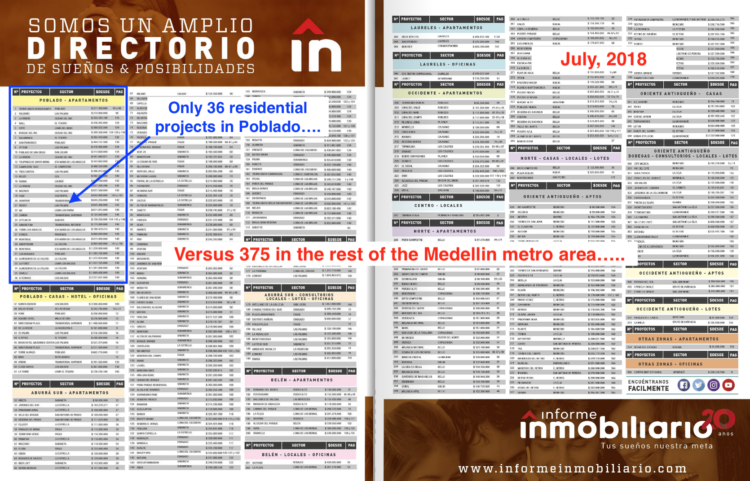

See the graphic below where the blue box represents all projects in Poblado in construction and various stages of development for the next few years totalling 36 projects. And compare that with the rest of the local market of 389 projects in other areas of the city. I wish I had the Informe Inmobiliaria magazine from 2008 when I first start buying here, I’ve tried to find an old copy for a long time.

I remember vaguely but there were more than 100 or 150 projects in Poblado back then… and now less than 40. The fact is that between lack of developable lots, land prices and zoning, Poblado has been very hard to build on. And Laureles is even worse, there are only five (5!) small to medium projects in all of Laureles at the moment delivering in the next 3 years.

So if anything in Poblado (and Laureles) we have the opposite problem of insufficient supply (especially in studio-1 bedroom formats) to feed market demand. Prices are rising sharply in this segment due to a legitimate deficiency of supply and no desire by city planning to rectify the imbalance in order to keep a lid on perceived traffic problems.

However the 200 projects just in Sabaneta and Bello alone, some of which have more than 1000 units for sale, could be another story in years to come. If for any reason the market demand cannot absorb the supply then some developers are going to get hit holding the bag.

Summary

I’m hoping someone could defend an intelligent position that the broad Medellin real estate market is subject to a bubble, I’d love to have the debate and see another perspective. But given the factors described above, I see a market which is mostly balanced, fairly priced, lacking speculation and driven by underlying economic fundamentals.

The economy is doing well, the COP has been trending up, tourism and foreign investment are rising and the city and country is mosty well managed. I think these are generally good conditions for the Medellin real estate market to meet or beat total returns in both developed and other emerging markets in the years to come.

Contact me or my team at any time to discuss the best investment opportunities we can find here.

Follow instagram for more content: @casacol_colombia

Brad.

Thanks for finally explaining the mystery of Poblado/Laureles pricing versus the rest of the MDE market!

Brad, Any truth to the rumor that Barrio Colombia will be cleared for condos in the immediate future?

Hi Brad

Real estate market in Colombia is quit confusing for me, I wonder where to invest, Medellin, Serena Del Mar – Cartagens, or even Bogota.?

Can you give me your vision on this country ?

Thanks