Tax time for filing Colombia income taxes for 2015 is fast approaching. In Colombia personal income tax returns are filed later in the year than in the U.S.

In Colombia, the dates to file personal tax returns for the prior year normally start in August. Personal income taxes in Colombia are known as “renta personas naturales.”

DIAN is the agency in Colombia responsible for collecting income taxes. DIAN performs similar functions as the IRS does in the U.S.

Note the following is based on my understanding of Colombian income taxes based on my experience in filing taxes in Colombia. It is also based on my discussions with my Colombian tax accountant.

But keep in mind I am not a tax expert. We strongly recommend consulting a tax expert. Also beware there is a lot of inaccurate and old information about Colombian income taxes out on the Internet.

Note the official exchange rate on December 31, 2015 was 3,149.47 pesos to the US dollar, which is used in this article. UVT for 2015 is 28,279 pesos.

Filing Colombia Income Taxes – Requirements

An individual is considered a Colombian resident for tax purposes if he or she stays in Colombia for more than 183 days during a year. This is whether or not the stay was continuous during the year.

Also this year is any 365 day period so it is not necessarily a calendar year, it can straddle two years. For example, 100 days in the last six months of year one and then 84 days in the first five months of year two (the next year) would make you a tax resident in year two.

If you are considered a Colombian resident for tax purposes, you are not required to file income taxes in Colombia if all of the following requirements (for 2015) are met:

- Gross income in 2015 is less than 1,400 UVT, which is 39,591,000 pesos ($12,751 USD at official exchange rate at end of 2015)

- Gross equity (net worth) on the last day of 2015 does not exceed 4,500 UVT, which is 127,256,000 pesos ($40,405 USD).

- Credit card consumption in 2015 does not exceed 2,800 UVT, which is 79,181,000 pesos ($25,141 USD).

- Total value of purchases and consumption in 2015 does not exceed 2,800 UVT, which is 79,181,000 pesos ($25,141 USD).

- Total value of accumulated bank savings, deposits or financial investments held at the end of 2014 does not exceed 4,500 UVT, which is 127,256,000 pesos ($40,405 USD)

If you are a Colombian resident for tax purposes and exceed any one of these amounts, you are technically required to file income taxes in Colombia.

Note that Colombia taxes worldwide income, just like the United State does. If your worldwide income is $12,751 or over and you are a tax resident of Colombia you are technically required to file income taxes in Colombia.

That is a pretty low-income barrier for needing to file taxes. There is a penalty for not filing income taxes in Colombia even if you don’t owe any taxes.

The minimum penalty for not filing if you are required to in Colombia is reportedly 10 UVT or 282,790 pesos.

If you didn’t file and owed taxes, the normal penalty is at least 5% of what was owed but reportedly can go as high as 200%. Plus you add interest on unpaid amounts that runs about 30% per year. DIAN can reportedly audit you for up to two years.

When and How to File Colombia Income Taxes?

Your Colombia income taxes filing date depends on the last two digits your Colombia tax ID number, which is known as a Número de Identificacíon de Tributaria (NIT).

The filing dates in Colombia for income taxes for individuals for the 2015 tax year start in 2016 on August 9 and run until October 19.

The complete schedule of filing dates for 2015 Colombia personal income tax returns during 2016 can be found on the DIAN website here.

Once your Colombia tax return is completed on a Form 210, you simply take it to any bank and pay the tax due or get the form stamped as processed without payment if you don’t owe any taxes.

How to Get a NIT

To get a NIT, you must go to a DIAN office to request one. The NIT is found on a RUT (Registro Único Tributario) form that will be given to you when you go to a DIAN office.

In Medellín, to get a NIT you just need to go to the DIAN office in the Alpujarra administrative complex.

DIAN’s office in Alpujarra is located in the basement of one of the buildings. You can ask any of the security guards which building has the DIAN office.

When you enter the DIAN office at the entrance just say you need a NIT for the first time.

You will need to bring your original ID (cedula or passport) and a copy of your ID (front and back of cedula or data page of passport).

They will direct you to a reception desk that will give you a number to wait your turn. Watch the monitors for your number.

When your number is called you go to a desk and they will ask you for the copy of your ID. They will also ask for your address, your phone number and for an activity code. The activity code is the type of work you do. A list of activity codes (in Spanish) can be found here.

The entire process in the DIAN office in Medellín took me less than 20 minutes when I did this last year. I understand the DIAN office is often less busy in the mornings.

Colombia Income Tax Rates

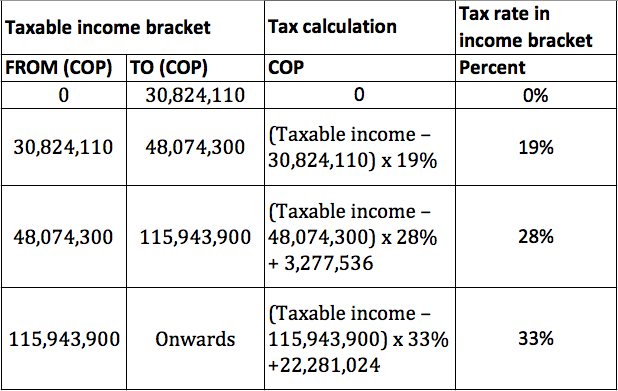

Colombia has progressive income tax rates like in the U.S. that max out in Colombia at 33 percent. The following is the tax table for 2015 income taxes in Colombia:

Note that there isn’t any tax break in the tax rate schedule for Colombia for your marital status (being married) or for having children. However, it is possible to have a limited deduction from your income in Colombia for dependents.

Calculating Colombia Income Taxes

In Colombia income taxes are calculated starting with your gross income. According to my accountant something new for 2015 is that interest from savings is exempt from income taxes.

While I am still many years from retirement age I asked my accountant about U.S. Social Security. She said that foreign pensions/retirements are taxed in Colombia according to a ruling from DIAN. However Colombian pensions are exempt from Colombia income taxes (up to a limit).

To calculate Colombia income taxes you start with gross income and deduct a variety of deductions including:

- Expenses related to receiving your income – this could include such items as travel expenses and home office expenses

- Mortgage interest for the taxpayer’s dwelling – limited to 1,200 UVT, which is 33,934,800 pesos ($10,775 USD)

- Colombia health insurance – Payments towards medical insurance in Colombia that is limited to 192 UVT, which is 5,429,568 pesos ($1,724 USD)

- Economic support of dependents – limited to 384 UVT, which is 10,859,136 pesos ($3,448 USD)

- Pension/retirement savings contributions – limited to 3,800 UVT, which is 107,460,200 pesos ($34,120 USD)

- 25 percent of your labor salary (gross income minus costs and deductions) – which is exempt from taxes up to a limit of 2,880 UVT, which is 81,443,520 pesos ($25,859 USD)

The result after subtracting deductions is your taxable income.

You then calculate Colombian income taxes due for your taxable income using the Colombia income tax table (see above).

After calculating Colombian income taxes due you can subtract income taxes paid in another country.

For example, I have a job in the U.S. but work remotely from Colombia. I pay income taxes in the U.S. on my income since the U.S. taxes citizens wherever they are in the world.

I also file income taxes in Colombia. But I didn’t have to pay any income taxes in Colombia last year for 2014 since I paid more income taxes in the U.S. for 2014 than my calculated Colombian income taxes due. So after subtraction my net income taxes due in Colombia last year was zero.

What Exchange Rate to Use

For end-of-year bank statements, credit card statements and account statements in another currency used to show net worth you should use the the official exchange rate on December 31, 2015, which was 3,149.47 pesos to the US dollar.

For a salary you receive and expense payments you make over the year in another currency you have two option for the exchange rate to use. You can the use official exchange rate on December 31, 2015 (3,149.47) for the annual total of each item. Or you can use the official exchange rate on the day when you receive or pay each item.

For example to convert an annual salary to pesos to be used to calculate Colombian taxes you could just use the December 31, 2015 exchange rate for the total.

Or you could use the official exchange rate on the date of each salary payment received during the year multiplied by each individual salary receipt. If you were paid twice a month you would have to make 24 calculations with 24 different exchange rates. You would also need records for each salary payment received such as pay-stubs.

Here’s a list of official exchange rates in Colombia during the year 2015. On January 1, 2015 the exchange rate was 2,392.46 pesos to the USD. By year-end this had increased to 3,149.47.

For 2015, if you received a monthly salary in USD it would covert to fewer pesos for Colombia tax purpose if you calculate using the exchange rate on the date of each salary payment during the year.

Possible Marriage Tax Penalty in Colombia

My tax situation changed in 2015. I got married in Colombia last year. The Colombian peso exchange rate also dramatically changed during the year from the end of 2014 to the end of 2015.

The change in the exchange rate during the year basically pushed more of my U.S. income in terms of pesos into higher tax brackets in Colombia.

The end result of these two changes is this year is I will have to pay some income taxes in Colombia for the first time. But my income taxes in Colombia for 2015 are less than 10% of my income taxes in the U.S.

This is partly because of the higher exchange rates last year, especially toward the end of the year. In addition I paid fewer taxes in the U.S. for last year due to now being married. So I have fewer U.S. taxes to subtract from my Colombian taxes due.

There being no such thing as married filing jointly in Colombia, everyone files separately.

Because of this if one spouse earns most of the income there is possibility of a “marriage tax penalty” in Colombia in comparison to the U.S., which has separate tax brackets for married couples. This depends on income levels and the income split between spouses.

In the U.S. there can be a marriage tax bonus (paying less taxes) when two individuals with disparate incomes marry due to the wider tax brackets for married couples.

The Bottom Line

If you think you need to file a Colombian income tax return, you should talk to a tax expert. A tax expert can help you navigate all of the Colombian regulations, determine what you can deduct, and help you file.

I use a bilingual accountant to file my Colombian income tax returns. She has many expat clients and her name, title and contact information are:

Paula Cruz, Colombian Public Accountant, email: paulaandreacruz@gmail.com, Skype: cliping21

My cost this year for filing taxes in Colombia using her services was 350,000 pesos ($120).

If you work remotely in Colombia with a job in the U.S. as I do, it is possible that you may not have to pay any income taxes in Colombia as I did last year.

Or you may have to pay some income taxes in Colombia, depending on your personal situation. The bottom line is that moving to Colombia can be tax neutral for some but not all. Moving to Colombia had been tax neutral for me until this year.

I work remotely in Colombia, my employer is based in Europe. So I receive monthly income from outside Colombia.

– You write about the penalty for not filing income taxes in Colombia. How does DIAN know that I gain money outside Colombia if I don’t declare it? Will they ever know it when I don’t declare anything? Do they ask proof of your income?

– What exchange rate do I use to calculate my gross income in 2015 in pesos? The exchange rate of the respective days when I received my income? Or the rate of december 31?

The 25% exempt was new for me, and quit a relieve :-).

DIAN has some agreements in place to exchange information with other countries. I am aware that Colombia and DIAN put in place an agreement with the IRS in the US recently, I believe it was last year. Both countries obviously did this to pursue tax evaders. I understand Colombia has agreements with some other countries but I don’t have a list.

DIAN could get a list of foreigners with visas living in Colombia from Migración Colombia and check to see if they filed taxes in Colombia. I suspect there are probably not many foreigners from Western countries (US, Canada, Europe, Australia, etc.) living in Colombia with an income of less than $12,751 so most should technically be filing taxes in Colombia if they are here more than 183 days. Regarding DIAN finding out about your income outside of Colombia it depends on if they have agreements in place. They could possibly look at where you live and lifestyle to estimate your income if they were auditing you.

If you live here and don’t file taxes when you are required to you are taking a risk. You’ll have to decide if the risk is worth it to you. Also if you plan to apply for dual citizenship in Colombia one of the requirements is to demonstrate you file tax returns in Colombia.

The exchange rate used for calculating taxes is the official exchange rate on the last day of the year – December 31, which was 3,149.47 pesos to the US dollar for 2015.

Ouch, the exchange rate on the last day 2015 was about 30% higher than on the first day of 2015. I didn’t receive all my income in december. Seems unfair.

Yes ouch. I agree with you it’s not fair. To me they should use an average exchange rate over the year. That high exchange rate the last day of the year is the main reason I’ll have to pay some income taxes in Colombia for 2015.

I tried to do some further investigation in the Internet (and I know there is ‘a lot of inaccurate and old information’), and I am wondering if you’re right.

Searching for “tasa de cambio para efectos tributarios” the first result (but might depend on my browser/Google: https://www.google.com/search?num=100&newwindow=1&q=%22tasa+de+cambio+para+efectos+tributarios%22) is a document called ‘Oficio N° 040924 de 11-07-2014’, which is a letter by DIAN. I quote:

“1. ¿Qué TRM se aplica para calcular el equivalente en pesos colombianos de divisas percibidas por un nacional residente en Colombia y que deben ser relacionadas en la declaración del impuesto sobre la renta y complementarios?

“El artículo 7º del Decreto 366 de 1992 señala:

“ARTÍCULO 7o. TASA DE CAMBIO PARA EFECTOS TRIBUTARIOS. La tasa de cambio para efectos tributarios, será la tasa representativa del mercado vigente al momento de la operación, o a 31 de diciembre o al último día del período para los efectos del ajuste por diferencias en cambio de los activos y pasivos poseídos en moneda extranjera a dicha fecha, certificada por la Superintendencia Bancaria, de acuerdo con lo dispuesto en el artículo 2.4.0.07 de la Resolución 57 de 1991 de la Junta Monetaria, adicionada por las Resoluciones externas número 15 de 1991 y número 6 de 1992, de la Junta Directiva del Banco de la República, o las normas que lo modifiquen.

(…)

PARÁGRAFO. La tasa de cambio aplicable a los días en que ésta no se certifique por la Superintendencia Bancaria, será la tasa representativa del mercado que corresponda a la ultime fecha inmediatamente anterior en la cual se haya certificado dicha tasa.” (negrilla fuera de texto).”

“De manera que, de la lectura de la antepuesta norma, se desprende que el nacional residente en Colombia que deba declarar por concepto de impuesto sobre la renta y complementarios divisas extranjeras percibidas en el año gravable, puede utilizar la TRM, certificada por la Superintendencia Financiera de Colombia, vigente: 1) Al momento de la operación, 2) a 31 de diciembre o, 3) al último día del período para los efectos del ajuste por diferencias en cambio de los activos y pasivos poseídos en moneda extranjera a dicha fecha.”

I understand that for my income I can use “la tasa representativa del mercado vigente al momento de la operación”, or in normal English: the rate at the time of the operation. My Spanish isn’t perfect (and neither my English). So how do you understand the above part?

However, when calculating the worth of properties and debts, is does seem logical to use the rate of December 31.

BTW The official rates can be found here: http://www.portaltributariodecolombia.com/wp-content/uploads/2016/04/CIRCULAR-000011-DE-ENERO-29-DE-2016.-TASA-REPRESENTATIVA-DEL-MERCADO-2015..pdf

Hi Michael,

Thanks, I found something similar on another website today so I sent an email asking my accountant about this today.

The way I interpret that is you have an option to use the TRM (exchange rate) at the end of the year or the “time of operation”. To me this means you could use the TRM on the date of each of your salary payments during the year to calculate your gross income in pesos. This would reduce your total gross income for the year in terms of pesos for the purposes of Colombian taxes.

I’ll let you know what I find out and will update the post above if needed.

Hi Michael,

I confirmed with my accountant that you can use the TRM on the date of each of your salary payments received. Basically you can calculate every transaction during the year using the TRM on each date or just use the TRM on Dec 31st. It will take longer and require better records but since the TRM (exchange rate) on Dec 31 was pretty high it’s better to do it at the “time of operation” for 2015 taxes.

Great! Thanks for this good news.

Jeff,

What is the difference between the gross taxable income of USD $12,751 and “labor income” (adjusted gross income) of USD $25,859.00? In my research I had always interpreted this tax code to mean that if my annual income from all sources was less than the 25,859.00 that I wouldn’t even need to file.

The requirement to file by DIAN is defined as gross taxable income is 1,400 UVT for 2015, which was the same as 2014. UVT and the exchange rate changes each year. UVT for 2015 is 28,279 pesos and the official exchange rate on December 31, 2015 was 3,149.47 pesos to the US dollar.

Here’s the same information for 2015 straight from DIAN in Spanish – http://www.dian.gov.co/descargas/normatividad/2015/Decretos/Decreto_2243_24_Noviembre_2015.pdf. Look at page 4.

Correction to above. Expat residents who do not derive any income from inside Colombia.

Colombia taxes worldwide income if you are a tax resident. Look at page 5 in the DIAN document I referenced in my above comment, which has the same filing requirements for residents as employees or freelancers.

It would seem that the information about taxes on “expat focus” is wrong as to where the income is derived. Is it also mistaken about its seeming claim that one doesn’t become a tax resident until after five years? I had read that five year claim somewhere else too. Needless to say I’m confused on this important subject but won’t belabor this with any more doubts or comments. Thanks for bringing the updated information to our attention.

http://www.expatfocus.com/expatriate-colombia-taxation

That link is an example of inaccurate and old information found on the Internet. It has much incorrect information. For example, there is no 10% or 35% tax bracket as claimed in the first sentence.

Not becoming a tax resident until after five years is out of date information from several years ago. Starting in 2013 any year you are in Colombia for over 183 days you are considered a tax resident.

I forgot to say this: great article! It is hard to find clear, up-to-date and correct information regarding taxes in Colombia, especially in English. Back in my home country I never felt the need of an accountant because I could already find all the answers myself. Here in Colombia I already asked several accountants, and none of them could answer my questions (even the most simple one: should I declare taxes?)

Thanks!

Agreed!

Great Article.

Useful information.

Great article again Jeff. I wentnto the Colombian consulate and they said my US pension would not be taxed in Colombia. So some more info please on pensioners.

The

Marc

I wouldn’t trust information provided by someone at a consulate. They wouldn’t be an expert on Colombian tax codes. I recommend talking to an experienced tax professional that has experience in filing Colombian tax returns for retired foreigners.

DIAN issued a ruling in 2014 that foreign pensions are taxed entirely in Colombia. Here’s an article in Spanish from last year that discusses this: http://www.gerencie.com/tratamiento-de-la-pension-extranjera-de-residentes-en-colombia.html.

Thanks for the info. Can I speak with your accountant to find out what exactly I would have to pay?

Contact information for my accountant is in the article above.

Never mind my last question. I see you added the e-mail address of your tax consultant.

Sry for typos. That’s went to. And thx

Thanks very much Jeff! I really had no idea if we were required to file income tax here…great info!

So, the actual Income line from a 1040 to be reported in Colombia is: (22) Total income, (37) Total adjusted income, or (43) taxable income? This is my first year paying double taxes (US and COL), and almost fainted yesterday when my local accountant gave me the amount owed in Colombia, even after I already paid over $50K in the US back in April.

Other questions:

1) Can the income of an LLC (taxed as S Corp) be protected from “Worldwide personal income”?

2) Rental income is also reported after or before deductions?

Thanks in advance for you help.

Juan

My understanding is that total income is gross income but not from the 1040 it’s gross income from your pay stubs before any 401k deductions. It’s essentially line 2 of your W2 for a salary. But you can deduct pension savings when filing taxes in Colombia.

Other taxable income must also be reported such as rental income and interest income. You’ll have to ask a tax expert about S Corps. Sounds like your taxes are fairly complex so definitely should be talking to someone experienced with doing expat taxes in Colombia.

Make sure your accountant includes all the deductions in Colombia listed above in the article. You can also deduct expenses for producing a rental income.

The $50k you paid in income taxes in the US can be subtracted from income taxes due in Colombia.

Make sure your accountant accounts for your income and income tax payments using the exchange rate during the year in 2014 for each income receipt. You will likely have less income in terms of pesos that way as the exchange rate on December 31 was pretty high and was much lower earlier in the year. By doing this I paid 72% less in Colombian income taxes than if I would have used the end-of-year exchange rate.

Please note that you will be considered a tax resident if you spend more than 183 days in Colombia in any 365 day period, not necessarily all in the same year. It is not 183 days in a year as stated in the article, which implies the same calendar year..

This site gerencie.com explains it in Spanish (search for 183) and cites the law “artículo 2 de la ley 1607 de 2012”:

http://www.gerencie.com/residencia-para-efectos-tributarios.html

You can find the same info on the DIAN website but it’s a bit harder to find. If you search for “ley 1607 de 2012” the first hit is a PDF from DIAN of the law, and Article 2 has the pertinent info as to what makes one a resident for tax purposes:

“ARTíCULO 2°…

1. Permanecer continua o discontinuamente en el país por más de ciento ochenta y tres (183) días calendario incluyendo días de entrada y salida del país, durante un periodo cualquiera de trescientos sesenta y cinco (365) dias calendario consecutivos…”

Thanks. Yes the 183 days in a year is not a calendar year and can straddle two years. I updated the article to clarify. For example 100 days in the last six months of year one and then 84 days in the first five months of year two (the next year) would make you a tax resident in year two.

You say you can deduct the amount of US taxes paid when calculating your Colombia tax owed. But I thought the whole tragedy of not having a bilateral tax agreement with the USA was that you’re subject to taxes in both countries. You’re certain that Colombia lets you deduct taxes paid in another country even if no tax treaty exists? In this case what’s the difference between income earned in the US, and income earned in country with a tax treaty in place (Canada, for example)?

Yes you can definitely subtract the amount of US income taxes paid from income taxes due in Colombia. There is a spot on Colombia’s tax filing form to subtract income taxes paid in another country. I have done this each time I have filed taxes in Colombia even though Colombia doesn’t yet have a tax treaty with the U.S.. My tax return in Colombia has been prepared by a Colombian tax accountant.

See “Salary earned from working abroad” from KPMG here: https://home.kpmg.com/xx/en/home/insights/2011/12/colombia-income-tax.html

“The salary earned from working abroad is taxable in Colombia, when the individuals are considered as resident for tax matters. However, the Colombian tax legislation allows to take as a tax credit the taxes paid abroad on the foreign source income, only to the amount that such income would be taxed in Colombia.”

Every country I know of does this for income earned in other countries so you avoid double taxation even if there is no tax treaty in place. If a country double taxed income no expats would ever live there.

Here’s Canada’s tax treaty with Colombia: https://www.fin.gc.ca/treaties-conventions/colombia08_1-eng.asp. I recommend talking to a tax accountant if you have further questions.

Just want to share this useful information on Colombian tax requirements and basic information on Colombian visas from Ernst and Young:

http://www.ey.com/GL/en/Services/Tax/Worldwide-Personal-Tax-Guide—XMLQS?preview&XmlUrl=/ec1mages/taxguides/TGE-2015/TGE-CO.xml

Hi Jeff,

I just wanted to say thanks for the work you’ve done to put this explanation together. It is super helpful! I had several near heart attacks while putting this years taxes together, but the different deductions, taxes paid in U.S., and calculating month by month brought my Colombian tax down to zero.

Thanks!

Jonathan

Hi Jonathan,

Thanks. I wrote this as I have seen so much inaccurate and out-of-date information about Colombian income taxes on the Internet.

Hi Jeff,

I have a question for you about Social Security taxes in Colombia. My wife and I are trying to move to Medellin in January for a year, and she would be in the same situation as you — working remotely for a U.S. company but living in Colombia. Her firm has said it will be very expensive for her to work remotely from Colombia, in part because of Social Security taxes. I can’t seem to find conclusive data on the SS tax rate in Colombia, for starters, and wonder if you know what the rate is for companies who have employees living in the country. Also, what do you know about the pyramid effect? Do you pay your portion of the SS tax to Colombia yourself, or does your company? Any help would be much appreciated. Badly want to move to Medellin, but unless we can figure out a way to limit the tax liability for my wife’s firm, it’s not going to happen.

Hi Adam,

The U.S.-based company I work for doesn’t have an office or subsidiary in Colombia so there is no need for my company to pay any taxes in Colombia. My company permits some seasoned employees to live where they want to. We have some employees living in countries where we don’t have an office or subsidiary, for example we have one also working from home in Spain. I still have a mailing address in the U.S. and I collect a salary in the U.S. from a U.S.-based firm and my company withholds social security taxes in the U.S. and income taxes in the U.S. I have met two other expats living here in Colombia working for other companies in the U.S. doing the exact same thing.

I see. Thanks for the response, Jeff. This would not apply to my wife, since her firm has a subsidiary in Colombia.

Really great information Jeff thank you for taking the time to research and put the information out. I had no idea until I saw a post on a Facebook page from a pensioner. When applying for a Visa, they do not tell you this information up front which is disheartening. If I had not found the information and asked I’m wondering if anyone would have ever told me.

Thanks for the super post with all the details. It really helps a lot. I have been reading up on this topic quite a bit since I have recently (end of Oct 2016) arrived in Colombia with the intent of establishing my home here. I even got my Cedula as a pensioner already. But now I am seriously reconsidering given the possibility that 1/4 to 1/3 of my USA social security (my only income and not taxed at all in USA) would be levied as a Colombian tax!

I’m not willing to risk the “don’t report and maybe they won’t catch me” method. It’s pretty clear that the Colombian government already has all my info on what my pension is since I had to submit that paperwork to get the visa! And hoping that their agencies are splintered (ie immigration doesn’t talk to DIAN) seems like a bad choice as well.

So I think the only way I can be for sure safe now is to stay under the 183 day rule. I hope that Colombia comes to it senses and realizes that the way to attract more foreign retirees is to NOT tax them on their pension. The retirees will come and spend all their money here, thus helping the economy, creating more jobs for locals, etc.

But I do actually have a question here… regarding the phrase “anyone who STAYS in Colombia”. Does this mean staying here on ANY visa, even a tourist visa? Or just days as a “resident” on one of the other available visas?

Since I visited Colombia in the spring of this year, I racked up 89 days as a tourist, plus recently 11 more days as a tourist before receiving my TP7 visa. To be totally safe I’m counting those 100 tourist days towards the 183. But that means I’ve got to leave the country BEFORE I’ve been here 83 days on my TP7! I sure would love to be wrong here. I really don’t want to have to rush off and leave the Colombia when it seems I just got here.

Thanks in advance for any clarification on whether or not tourist days count towards the 183 days.

Yes, I understand that tourist days will count towards the over 183 days for becoming a tax resident. Any time spent in Colombia, with or without a visa counts.

Also the over 183 days can straddle between two years – for example, 100 days in the last six months of last year and 84 days in the first six months this year, would technically make you a tax resident this year.

OMG….I am looking forward to approx. $60K in combined SSAN & Pension payments annually. I will be paying some taxes to Uncle Sam, but I didn’t plan on paying even more to the Colombian govt. !!! Any break that Uncle Sam gives us will be negated on the other end by the Colombian govt…Lose, Lose situation. I will need to crunch the numbers some more, but it is looking like my adventurous fact finding mission about retiring to Colombia is screeching to a halt. Very disappointed, but very thankful Jeff has brought this to our attention!

I have tried to contact Paula with the info below, the recommended attorney on this site but got no reply, does anyone no how to contact her, or can anyone recommend a good tax attorney in Medellin?

Paula Cruz, Colombian Public Accountant, email: paulaandreacruz@gmail.com, Skype: cliping21

Hi Suzann,

I am from India and looking for Pension Visa TP7 for me with my wife. Can you advise how and what documents require for the same.

Thanks a lot, great help understanding the laws.

Hi Jeff

Thx again for this great article.

Being seaman i was wondering how do you prove being out of 180days to don’t pay taxes?

I plan to have visa here then registered to the embassy but at this point i m scare that i will have pay my taxes in Colombia. But with my job i m out of colombia more than 183 days per year how do you prove it when filling up those papers.

Thx.