Keeping informed and updated about taxes always seems to be a difficult task – made even more problematic when living abroad and perhaps not understanding the local systems or language. However, taxes are a necessary part of life and being in the know could save you significant time and money.

What is IVA tax?

A question many foreigner visitors have when visiting Medellín is about IVA tax (Impuesto Valor Añadido); more commonly known in English as ‘Value-Added Tax’ (VAT). Value-added tax is the amount a product or service has added to reflect how its value has increased at each stage of distribution or production. It’s also sometimes referred to as a national tax.

How much is IVA tax?

It’s important to note that the percentage of VAT ranges depending on the country. Currently, VAT tax in Colombia is 19% (for reference, Europe sees VAT average around 20%, Mexico’s is 16%, and Argentina’s is 21%). It’s worth noting too that some items and services are taxed at a lower rate; for example, in Colombia reduced taxes are applied to real estate, coffee, cotton, timber, medical insurance, electric and hybrid cars, and agricultural supplies.

Who can reclaim IVA tax costs back from Colombia?

The majority of countries around the world utilize a value-added tax system and incorporate the extra cost in the overall price tag. However, the USA is one of the few countries that does not adopt VAT, so if you’re American, the concept may be completely new and you may not realize that you are entitled to a 100% tax refund on certain products purchased while in Colombia. There are, unsurprisingly, a few restrictions and processes that have to be followed in order to get the refund.

Firstly, to be eligible for the refund the following has to apply to you:

– You are a foreigner visiting Colombia for a short time

– You entered Colombia on a tourist visa

– You are not a Colombian national with dual citizenship for another country

In Colombia, IVA is collected by a government agency called DIAN (Dirección de Impuestos y Aduanas Nacionales). Taxes are automatically incorporated in the price of goods, and on the receipt of any purchase you’ve made in the country, you can find the full breakdown of the taxes.

The purpose of the tax refund is to encourage tourists to buy Colombian products to take back to their home countries. It’s for this reason that dual-citizenship holders cannot claim their money back. Equally, foreign companies operating in Colombia may not reclaim IVA incurred while in the country.

Does the refund apply to all products?

While all foreign tourists can apply for a tax refund on goods they have bought in Colombia, not all products qualify for tax exemption. These include:

– Food (restaurant or grocery receipts will not be accepted)

– Accommodation

– Alcohol

– Electronics (laptops, phones, watches etc.)

– Medical costs (insurance, surgeries, hospital visits, medication)

The most common IVA refunds are submitted for things like clothing, shoes, jewelry, perfumes, appliances, leather goods, and toys.

How do I submit a refund request?

The process to claim IVA tax back is relatively straightforward. You’ll need to have all the receipts for the things you want to request the IVA back for. Then, you’ll have to visit a DIAN office – these can be found at any international airport across Colombia. In the Medellín international airport (José María Córdova), the office is on the left-hand side of check-in for Avianca flights. The office is open 24-hours a day but if you have any questions in advance, you can call them on +57 456 228 54.

Before you arrive at the DIAN office, you’ll need to add the value of all the purchases you’ve made and are claiming a tax refund for. To be eligible for the money back, the total amount has to be equal to or more than 10 Unidades de Valor Tributario (UVT), which basically means tax value units. As of 2019, UVT in Colombia is $34,270 COP, so multiplied by 10 equals $342,700 COP (just under $99 USD) – the minimum total value of all your purchases to be able to apply for the IVA refund. Alternatively, the maximum total value of all total purchased goods is capped at 100 UVT, so $3,427,000 COP (roughly $985 USD).

To summarize: the cost of all products added together must be between $342,7000 COP and $3,427,000 COP. There is also a restriction on the number of the same items being submitted for the refund – this is capped at 10. For example, if you have bought 15 identical perfumes, only 10 of these will be eligible for the tax return.

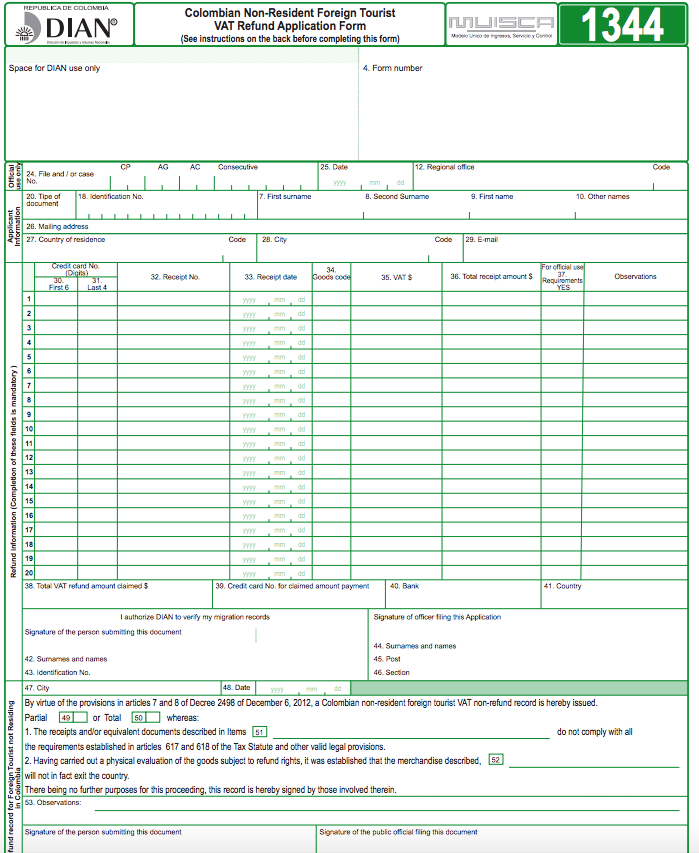

After you have sorted the total value and capped repeat items, you will have to complete the tax refund form (Form 1344) at the DIAN office. Although this form can be downloaded from the DIAN website, the office will not accept forms completed in advance.

Before filling out the form, note that only one IVA tax refund request can be made every four months, and that all claimed transactions must have been paid for in-person with a credit or debit card (cash payments do not apply to the exemption).

Form 1344 checklist

To complete the form correctly, you will need:

– Photocopies of all receipts (no more than six-months old)

– Card details for all the payments made

– A copy of your passport photo page

– A copy of your passport tourist visa stamp page

– The total receipt amount and VAT amount per transaction

Once the form is ready, hand it to the DIAN office before you check-in with your airline. You’ll also need to show your physical passport as proof of identity when you submit the form. The refund should be provided three months after the form is registered and will deduct any administration costs from the initial refund amount. The money back is normally processed as credit issued to an international credit/debit card. If you experience any issues or delays with your application, contact the DIAN at devolucion_iva_turistas@dian.gov.co.

I recently left Medellín and filled out this form. I discovered that if you have a student visa the refund also does not apply.

Thank you so much for the great information from Grace. Excellent information. Best, Francisco