Editors note: this post was updated in July 2016 with updated income tax information for Colombia.

Tax time for filing 2014 personal income tax returns in Colombia is fast approaching. In Colombia personal income tax returns are filed later in the year than in the U.S.

In Colombia, the dates to file personal tax returns for the prior year normally start in August. Personal income taxes in Colombia are known as “renta personas naturales.”

DIAN is the agency in Colombia responsible for collecting income taxes. DIAN performs similar functions as the IRS does in the U.S.

Note the following is based on my understanding of Colombian income taxes based on my experience but keep in mind I am not a tax expert. We strongly recommend consulting a tax expert.

Filing Taxes in Colombia – Requirements

An individual is considered a Colombian resident for tax purposes if he or she stays in Colombia for more than 183 days during a year, whether or not the stay was continuous during the year.

If you are considered a Colombian resident for tax purposes, you are not required to file income taxes in Colombia if the following requirements (for 2014) are met:

- Gross equity (net worth) on the last day of 2014 does not exceed 4,500 UVT, which is 123,682,500 pesos ($51,675 USD).

- Gross income in 2014 is less than 1,400 UVT, which is 38,479,000 pesos ($16,077 USD).

- Credit card consumption in 2014 does not exceed 2,800 UVT, which is 76,958,000 pesos ($32,153 USD).

- Total value of purchases and consumption in 2014 does not exceed 2,800 UVT, which is 76,958,000 pesos ($32,153 USD).

- Total value of accumulated bank savings, deposits or financial investments held at the end of 2014 does not exceed 4,500 UVT, which is 123,682,500 pesos ($51,675 USD).

If you are a Colombian resident for tax purposes and exceed any one of these amounts, you are technically required to file income taxes in Colombia. Note that Colombia taxes worldwide income, just like the United State does.

When to File Income Taxes in Colombia?

Your income tax filing date in Colombia depends on the last two digits your Colombia tax ID number, which is known as a Número de Identificacíon de Tributaria (NIT).

The filing dates in Colombia for income taxes for individuals for the 2014 tax year start in 2015 on August 11 and run until October 21.

The complete schedule of filing dates for 2014 Colombia personal income tax returns can be found on the DIAN website here.

How to Get a NIT

To get a NIT, you must go to a DIAN office to request one. The NIT is found on a RUT (Registro Único Tributario) form that will be given to you when you go to a DIAN office.

In Medellín, to get a NIT you just need to go to the DIAN office in the Alpujarra administrative complex.

DIAN’s office in Alpujarra is located in the basement of one of the buildings. You can ask any of the security guards which building has the DIAN office.

When you enter the DIAN office at the entrance just say you need a NIT for the first time.

You will need to bring your original ID (cedula or passport) and a copy of your ID (front and back of cedula or data page of passport).

They will direct you to a reception desk that will give you a number to wait your turn. Watch the monitors for your number.

When your number is called you go to a desk and they will ask you for the copy of your ID, your address, and your phone number and for an activity code. The activity code is the type of work you do. A list of activity codes (in Spanish) can be found here.

The entire process in the DIAN office in Medellín took me less than 20 minutes when I did this a while back. I understand the DIAN office is often less busy in the mornings.

Colombia Income Tax Rates

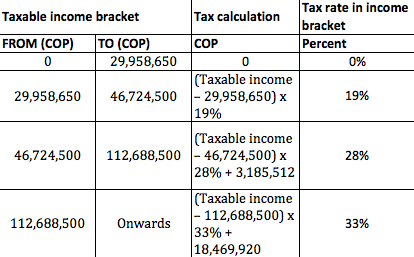

Colombia has progressive income tax rates like in the U.S. that max out in Colombia at 33 percent. The following is the tax table for 2014 income taxes in Colombia:

Note that there isn’t any tax break in the tax rate schedule for Colombia for your marital status (being married) or for having children. However, it is possible to have a deduction from your income in Colombia for dependents.

Calculating Taxes

In Colombia income taxes are calculated starting with your gross income.

You then deduct expenses related to receiving your income as well as any pension/retirement savings contributions with the result being your net income.

Colombia is much more lenient for home office deductions than in the U.S. I am able to deduct several home office expenses in Colombia that I am not able to deduct in the U.S.

In Colombia, 25 percent of your net income is exempt from taxes up to a limit of 2,800 UVT or 79,256,800 pesos. So you subtract this exempt income from your net income to get taxable income.

You then calculate Colombian income taxes due for your taxable income using the Colombia income tax table (see above).

After calculating Colombian income taxes due you can deduct income taxes paid in another country.

For example, I have a job in the U.S. but work remotely from Colombia. I pay taxes in the U.S. on my income since the U.S. taxes citizens wherever they are in the world.

I also file income taxes in Colombia, but I don’t have to pay any income taxes in Colombia since I pay more income taxes in the U.S. than my calculated Colombian income taxes due. I can deduct my U.S. income taxes on my Colombian tax return.

The Bottom Line

If you think you need to file a Colombian income tax return, you should talk to a tax expert. A tax expert can help you navigate all of the Colombian regulations, determine what you can deduct, and help you file.

I use a bilingual accountant to file my Colombian income tax return. She has many expat clients and her name, title and contact information are:

Paula Cruz, Colombian Public Accountant, email: paulaandreacruz@gmail.com, Skype: cliping21

My cost this year for filing taxes in Colombia using her services was only 330,000 pesos ($118).

If you work remotely in Colombia with a job in the U.S. like I do, it is possible that you will not have to pay any income taxes in Colombia, depending on your personal situation.

Jeff, good article. As a business owner here I have to deal with business taxes, which is another headache. But this was good info on personal income taxes. Another good article would be about health insurance, and paying into social security here.

There is some contention as to if you need to file a tax return if you, for example, own property or have assets over the 124 M tax limit, have a cedula, but are OUT of the country for more than 183 days. In fact, meeting with the above mentioned tax agent, she stated that in her opinión you would have to file.

My interpretation was that, yes I have a cedula, yes I have property, however I am only IN country 4 months a year and therefore I am considered a non tax resident and do not have to file.

Thank you Jeff for this informative article. I am planning on moving to Colombia next year on a Colombian Pension Visa where all of my income will be from Social Security while I am living there. Is this considered income for tax purposes or do they consider income only from jobs and investments in Colombia? Just curious since that may be a factor in whether I would want to retire there or somewhere else.

Hi Ray, since I don’t have a Social Security or pension income I don’t know the answer to your question based on my experience. I suggest you contact Paula Cruz (contact information in the above article) with your question.

Jeff,

You stated “In Colombia, 25% of your net income is exempt from taxes up to a limit of 2.800 UVT, or 79,256,800 pesos”. Are you sure about this as I have never heard of this before. There is already the o% tax band, so why should there be another general exemption?

Yes 100% positive, I did that last year on my filed Colombian taxes. There is an exemption of 25% of your income up to a limit of 2,800 UVT. Plus there is also a 0% tax band. See taxable income on page 3 in this: http://www2.deloitte.com/content/dam/Deloitte/global/Documents/Tax/dttl-tax-colombiahighlights-2015.pdf but it doesn’t mention the limit. There is definitely a 2,800 UVT limit to the exempt income.

Hi Jeff, thanks for your reply about the “25% exemption of your income from Colombian taxation (up to certain limits)”. However, in looking through Deloitte’s guidelines, it is not as simple as that. Only specific types of incomes are granted this 25% exemption…..not ALL incomes.

Accordingly, people reading this should take on board that MOST forms of income will NOT be covered by this exemption. Here are a few types of income that will not be exempt according to my (inexpert) opinion:

– Pension incomes from non-Colombian pension sources.

– Interest remuneration on nearly all types of Colombian bank and savings accounts.

Yes the 25% exemption up to a limit is for “labor income”. The exemption doesn’t include interest income from Colombian or foreign banks. I understand pensions from outside Colombia are handled differently than pensions from Colombian sources so I would recommend talking to a Colombian tax accountant/expert to see how they are handled. I am nowhere near retirement age so pension income isn’t part of my personal tax situation.

Hi, Jeff: I agree – it’s a very helpful, clearly written article. Thank you. Any further articles on health insurance would be great, and also, if you have any knowledge of capital taxation i.e. taxation on gains made on real estate investments, that would be very useful, too. Thank you so much.

If you are Canadian, I know a dual-qualified and bi-lingual Colombian/Canadian tax accountant, who will be doing my Colombian (and Canadian, late, my fault) taxes this year. His name is Luis Chavarragia and his email is luchochava@hotmail.com. He’s in the Vancouver, BC area. He’s been incredibly helpful to me in preliminary consultations about property investments. He has to do my taxes first, OK. and If you contact him, please tell him I recommended him. I’m Helena Clift.

Cheers

Helena

Out of curiosity, would you know if expats have to start paying Colombian taxes after year 1 of being in the country more than 183 days, or is does this rule apply: Colombian citizens and foreign nationals who have lived continuously in Colombia for a total of five years are thereafter subject to individual Income tax based on a system of graduated marginal tax rates?

If you are in the country more than 183 you potentially need to file taxes in Colombia depending on your situation (your income, etc). But just because you need to file taxes in Colombia, it doesn’t mean you need to pay taxes in Colombia. For example, I have an income in the U.S., pay income taxes in the U.S. and need to file taxes in Colombia but I pay no income taxes in Colombia as I can subtract the income taxes paid in the U.S. That five-year rule for expats is old and no longer applies.

Also keep in mind the 183 day rule is during any consecutive 365 day period. For example if you were in Colombia for 180 days from April to December 2015 and returned in February in 2016 for 4 days you would be liable for potentially filing taxes in Colombia in 2016 since you were in Colombia for 184 days in a 365 day period.

Got it. That’s incredibly helpful. Thanks.

Greetings!

great piece of information here, thank you for sharing.

I’m curious to know if you are still recommending Paula Cruz

thank you,

Yes I still recommend Paula. I am planning to use her again this year for filing my Colombian taxes.

I e-mailed Paula several times but she did not respond. If anyone knows of a professional accountant who is actively seeking new clients, could they please post their contact info?

+1

Jeff, Joe, anyone else that may be reading this…

I met Paula back in March and did a consultation. She was great to speak with, seemed very knowledgeable and so its kind of a bummer that she has gone dark. No longer responding to emails or phone calls.

Does anyone here in this community have another referral for a local accountant experienced with US citizens -living in Colombia and earning US. -?

Very helpful article. I am considering retiring in Colombia, most likely in either Medellin or Santa Marta. If I am in Colombia fewer than 180 days per calendar year, can I simply do this by getting a tourist visa each year and then avoid the whole double taxation issue? My plan is to spend the majority of the year in the US and stay in Colombia for 4-5 months per year, so I’m looking to confirm that the tourist visa would work in my case and I won’t risk my retirement income (e.g. 401k, social security, etc) at risk of also being taxed in Colombia.

Is it also correct that I shouldn’t have a problem buying/owning a house in Colombia as a non-resident, again, just there on a tourist visa for < 6 months per year?

Thanks very much!

Thanks. Yes you shouldn’t encounter a problem buying a property in Colombia as a non-resident. And no problem using tourist visas and staying up to 180 days each year in Colombia.

There is no double taxation in Colombia as you can subtract income taxes paid in another country from your income taxes due on Colombia. But Colombia does tax foreign pensions.

You should look at the updated 2016 Colombia Income Tax post on this site for more up-to-date information, see: http://medellinliving.com/filing-colombia-income-taxes/

Since Colombia does not have double taxation and you pay taxes in the US on your Social Security benefits and any income from stocks and or bonds, why would you own any taxes in Colombia on that income?

Hi Shelley,

Keep in mind the tax brackets, tax rates and tax deductions are different in Colombia than in the U.S. So your calculated income taxes can be different in the U.S. than in Colombia. For example, for two years my calculated income taxes due in the U.S. were higher than my calculated income taxes due in Colombia. So I didn’t have to pay any income taxes in Colombia since I subtracted income taxes paid in the U.S. from income taxes due in Colombia.

But last year (for 2015 taxes) my calculated income taxes due in Colombia were higher than my income taxes I paid in the U.S., so I had to pay some income taxes in Colombia.

Everyone’s tax situation is different. That is why we recommend talking to a tax professional in Colombia for your individual situation.

any updates on Paula?

Saw her back in April, but since then she has stopped responding to email and cant reach her via phone.

She was having some medical things going on,,