Many expats living in Medellín work remotely for a company in another country. This is known as being digital nomads with location independent jobs.

For the latest info on Medellin, check out the Digital Nomad Guide Medellin ebook!

I have lived in Medellín for over six years. I work remotely as a research analyst for a company based in the U.S. During this time, I have met many other expats living in Medellín doing something similar – digital nomads working remotely for companies in other countries.

With my job with location flexibility I have chosen to live full-time in Medellín with its low cost of living as well as good climate, public transportation, infrastructure and healthcare. But I could live and work from anywhere with reliable Internet services.

For example, I have worked remotely for over a month from several locations. This includes the beach cities of Santa Marta in Colombia and Rio de Janeiro in Brazil. I also spent over a month working from Pereira in Colombia’s Coffee Triangle.

All I need to do my job is reliable and high-speed Internet and voice-over-IP (VOIP) phone service with a U.S. phone number. When I lived in the U.S. I worked out of my home. It’s the same for me while living in Medellín – I work from home online.

I have met many digital nomad expats living in Medellín working remotely as I do. They have a variety of location independent jobs. This includes web development, software development, writing, copy editing, consulting, graphic design, translating and day-trading.

Information technology (IT) related location independent jobs such as web design, computer programming or software engineering are particularly attractive. With these types of jobs it being possible to earn over $100,000 USD a year.

Digital Nomads – Our Survey Results

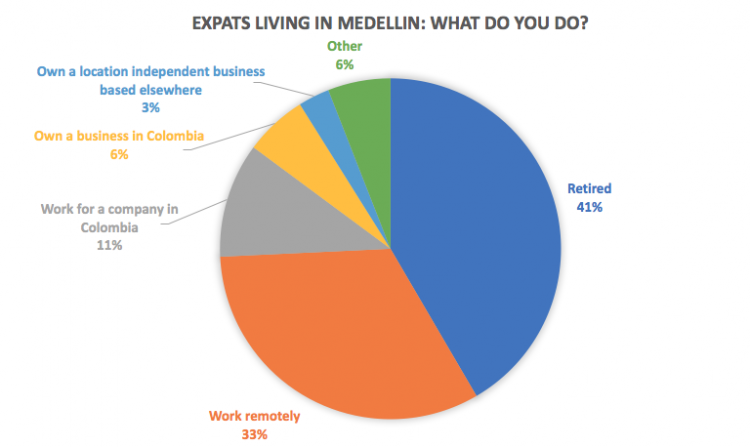

Preliminary results from our Medellín Living reader survey that is currently running is finding that there are more expats living in Medellín that are digital nomads working remotely for companies in other countries than expats that work for companies in Colombia.

Out of 100 survey responses received so far of Medellín Living readers that indicate they live in Medellín, 33% of these expats living in the city work remotely for companies in other countries.

Only 11% of surveyed expats living in Medellín have jobs with companies in Colombia. And only 6% of expats living in Medellín own companies in Colombia. While 41% are retired.

For those expats living in Medellín and working remotely, 87.9% have a Colombian visa. So while they are digital nomads with location flexible jobs, they have chosen to stay in Colombia for an extended time. 48.5% of these digital nomads have lived in Medellín at least three years.

Local jobs in Medellín typically don’t pay that well so it is possible to earn much more working remotely for a company in another country. I have met several digital nomad expats that earn six figure USD incomes living in Medellín. So, they can live like a king with the low cost of living in the city.

When I was taking Spanish classes at Universidad EAFIT I met several expats working as English teachers at EAFIT. One told me that he earned roughly $1,000 per month. He also received benefits such as health insurance.

He rented a room in a shared place with roommates as he didn’t really earn enough to live alone. But he was also taking Spanish classes for free at EAFIT with a goal of becoming fluent.

Note: if you haven’t yet taken our reader survey, please take 5 minutes to help the Medellin Living community and complete our first ever reader survey. The above preliminary result graphic is an example of the interesting information our reader survey is intended to provide.

We want to better understand our community and identify what you want from Medellín Living so we can continue to improve for you.

To provide a little extra motivation to complete the Medellin Living Reader Survey, each qualified response with an email address is entered to win a COP 300,000 gift certificate to Carmen Restaurant, one of Medellín´s best restaurants.

Infrastructure in Medellín supports Digital Nomads

The infrastructure in Medellín such as power and Internet services are reliable and support being a digital nomad in the city.

There are two major Internet providers in Medellín: Claro and UNE. Claro offers Internet speeds of up to 100 Mbps and UNE offers speeds of up to 50 Mbps.

I have had Internet service from Claro for over six years. My Internet service with Claro has been more reliable than my Verizon FiOS service was in the United States and of course it is much less expensive.

I have only experienced three Claro Internet outages in over six years. In each case I called Claro and service was restored within a couple hours.

I have lived in Medellín for over six years in several neighborhoods. During this time I experienced only three power outages. Electric service in the city is very reliable in my experience.

The only unplanned electric outage I experienced in over six year was for a couple hours during a major storm. I have never experienced an unplanned water outage.

Two other electricity outages I was notified about beforehand by the electric provider (EPM) and both were due to maintenance. One of these planned outages was over six years ago in Belén and one was recently in Sabaneta.

Tax Implications

If you work remotely in Colombia with a job in the U.S. as I do, it is possible that you may not have to pay any income taxes in Colombia. I didn’t pay income taxes in Colombia for my first five years living in the country.

Only in 2016 did I have to pay income taxes in Colombia for tax year 2015, which ended up being less than 10% of the income taxes I paid in the U.S.

You are considered a Colombian resident for tax purposes if you stay in Colombia for more than 183 days during a year.

We looked at income taxes in Colombia earlier this year on this site. Colombia taxes worldwide income, just like the United State does.

If your worldwide income was $12,751 or over in 2015 and you are a tax resident of Colombia, you were technically required to file income taxes in Colombia in 2016. But you may not have to pay any income taxes, depending on your situation.

When filing income taxes in Colombia there are many possible deductions. You can also subtract income taxes paid in another country from income taxes due in Colombia. The result is that it is possible to work as a digital nomad living in Colombia and pay no income taxes in Colombia.

I have met many expats living in Colombia working remotely like I do. Several of these expats don’t pay any income taxes in Colombia. They pay income taxes in the U.S. or another country on their income, which is more than their income taxes due in Colombia.

Moving to Colombia can be tax neutral. But we recommend talking to a tax expert as everyone’s situation is different.

The Bottom Line

There are more expats living in Medellín working as digital nomads with jobs from other countries than there are expats living in the city working for local companies in Colombia.

Jobs with location flexibility from other countries can offer the opportunity to earn much higher incomes than are available from many of the local jobs found in Medellín.

Expats planning to move to Medellín and find a job in Medellín may want to rethink this approach. Instead you may want to find a location flexible job in your home country before making the move to Medellín. It turns out that many expats living in Medellín have successfully done this.

Some expats have also been successful in opening businesses in Medellín. For example, there are successful foreign-owned real estate companies, hostels and restaurants in Medellín.

But starting a business can be difficult in a foreign country. So there really aren’t that many expats living in Medellín that have opened businesses in the city. There are more expats working as digital nomads living in Medellín than there are entrepreneur expats that have started businesses.

Panama City has been touted as a good city for digital nomads by some foreign living publications. But our recent Medellín vs Panama City comparison found that in many ways Medellín can be a better place to live.

The bottom line is that Medellín is expected to attract more and more digital nomads with location flexible jobs. This is due to Medellín’s low cost of living, inexpensive real estate, good climate and good infrastructure.

Exposure to the world-wide phenomenon of digital nomads happened for me in Medellin at an Airbnb in Laureles. I wanted a nice month long stay here before making the decision to move from Mexico. A bunch of DN’s were staying at my Airbnb too, and it was a real eye opener. It’s fascinating to be with people who give the impression that they’re off the grid but in fact they are very busy making a living on line. After their six month visas expire they sometimes move on to another country with reliable internet but several told me that they particularly liked it here and planned to stay on if they could work out some of the issues mentioned here.

Me too, me too…

Thanks for the great article Jeff. I am one of those people who submitted the survey. I work as a programmer (webmaster) for my clients in Israel. In my case there is a big time difference between Colombia and Israel – 7 hours during Winter and 8 hours during daylight saving time. Before coming to Latin America I was afraid that this might be an issue but it does not let down my clients at all as most of the time I work independently and only about twice a week have a Skype conversation – usually planned – with a client. Some clients actually like that I am available where in Israel it is already evening…

I was also living in Mexico, Costa Rica and Brazil and was travelling in countries like Nicaragua, Argentina, Chile, and Ecuador – nowhere the internet was reliable as in Medellín. This is also true for mobile services – I pay here about 35,000 pesos per month for my mobile phone – good for me.

Regarding the photo in this article… Well, this guy is cute but definitely not a nomad with this big computer (or you may say: “he works from a coworking space…” – and indeed there are quite a few of those in Medellín).

Thanks again for the great article!

Amir

What a great, great article. Once again you give all of the facts clearly! Good to know that someone really understands this issue! Everything’s there! Can’t wait to come to Medellin and live the high life!

Greetings,

are there any updates from this commmunity on a reliable Colombia based accountant that has experience with USA based remote employees and their income tax filing needs -And that is open for new clients?

In the “Filing Colombia Income Taxes (2016 Update)” article I wrote earlier this year I provide contact information for my Colombian accountant that I used the past couple years. See: http://medellinliving.com/filing-colombia-income-taxes/. I’m aware that she has many expat clients.

You are missing one important requirement for the foreign earned income exclusion – your tax home must be in a foreign country throughout your period of bona fide residence or physical presence abroad. See: https://www.irs.gov/individuals/international-taxpayers/foreign-earned-income-exclusion-tax-home-in-foreign-country

Two different experienced international tax accountants I have talked to in the US also said that is overly aggressive and likely to fail if tested by an IRS audit.

Also keep in mind that income can be taxable where it is generated. In many countries, if you have a work contract or employment relationship with a local company, income will by default (if no tax treaty or specific exception apply) be taxed locally even if you are not a resident.

But, if you don’t set foot in the country and export your services from somewhere else (without an employment relationship), you would typically not be liable for income tax where your clients are but you need to worry about the country where you and your company are located.

This is complicated stuff and everyone’s situation is different — that’s why we recommend consulting appropriate lawyers and accountants.

Most expats living in Medellín working remotely have a Colombian visa (87.9% per our survey preliminary results) and most of these expats also indicated they live in Colombia over 183 days per year (30 out of 33), so they would be tax residents of Colombia.

True that our reader survey isn’t scientific, it wasn’t intended to be. It is intended to survey the Medellín Living reader base so we can improve the site to better meet the needs of readers. It would be pretty impossible to identify all the expats living in Medellín and use scientific means to survey them. But the Medellín Living site has a big readership so we are likely hitting many of them.

Digital nomads that travel the world, not living anywhere long enough to become a tax resident and trying to avoid taxes using a loophole — that sounds like a lifestyle that is pretty difficult on relationships and family…. so not for everyone.

Regarding expats living here that are tax residents in Colombia and don’t file taxes – I have met a few expats that found themselves in trouble because of this and had to pay fines. Since I live here I want to follow the rules. IMHO it wouldn’t be difficult for DIAN to find all the expats that were here more than 183 days and didn’t file taxes.

Thanks for the great article. I am considering relocating to Medellin within the next two years, but I don’t know what to study that will enable me to make money online. I would appreciate it if you could point me in the right direction. What classes should I take and what skills should I obtain? Thanks for your reply.

Reasons for living in the city of eternal spring from digital nomad’s perspective: https://blog.vanja.ws/why-medellin-colombia 🙂

Interesting article and very timely. I’m a Canadian looking into becoming a Digital Nomad, and my dream is to live in Medellin and Rio de Janeiro. Someday I’ll make that happen and it’s nice to know that there are opportunities to make these dreams come true!

I’ll see you all in Medellin real soon!

Hey Jeff thanks for your post, really informative. I was wondering if you could advise on the average internet speeds in the internet cafes in Medellin? Thanks!!

Hi Brayden, I’m not sure as I have never used an Internet cafe where you have to pay as you can find free Wifi. You can find free Wifi in many places in Medellín like Starbucks, McDonald’s and Juan Valdéz that is reasonably fast but I haven’t done a Speedtest to see the speed or which is fastest.

I have 10 MB service from Claro in my apartment and could get up to 100 MB if I wanted to pay more.

Yes, it is fast.

The only problem is that some days an entire neighborhood can suffer from slow internet, but this has nothing to do with the cafe.

I haven’t ever experienced a slow Internet for my Claro 10MB service at home – only a few brief outages in over six years. I have experienced slowdowns and unreliability with free Wifi – but you get what you pay for.

Hi, well written article. Do you know the claro 100mbps service footprint? Thanks

Thank you for taking the time in writing this great and super informative article! Helps me tremendously on how to finally be living my dream! Blessings!

Awesome article, very informative. I am thinking of working remotely from Medellin for a US company and was wondering if your US company had to pay taxes in Colombia? FYI, my work/business will only be in the US, no business in Colombia, and the payroll will still be in the US. Was that the same for you? Thank you for your reply