I have now been living in Medellín for over six years and I have lived in six different barrios in the city. I have often been asked by many foreigners about the unfurnished apartment rental costs in Medellín.

I also have helped several foreigners find unfurnished apartments in Medellín. My experience in renting three unfurnished apartments was previously documented on this site in a four-part series. Read the first part here, the second part here, the third part here and the fourth part here.

I also covered my experience renting my latest apartment here. Also, I have seen several Internet blog posts and press articles that have inaccurately depicted the costs of apartment rentals in Medellín.

I recently surveyed with the help of my Colombian wife the rental costs of 1,000 available unfurnished apartments in several neighborhoods in Medellín.

This was to accurately answer the question: “What are the current unfurnished apartment rental costs in Medellín?”

We specifically looked in El Poblado, Laureles-Estadio, Envigado, Belén and Sabaneta. We only looked at 1-bedroom, 2-bedroom and 3-bedroom apartments. We did not look at casas (houses) or larger apartments.

This is an update of a very popular post last year that looked at apartment rental costs in these same neighborhoods in Medellín.

During this survey, we only looked in nicer neighborhoods where foreigners are more likely to live. We only included apartments in estrato 3, 4, 5 and 6 neighborhoods. Only a few estrato 3 neighborhoods were included.

This update with the latest apartment rental costs in neighborhoods in Medellín also permits seeing if rental costs have increased in these neighborhoods from our survey at the end of last year.

We also looked at furnished apartment rental costs late last year.

(Note: using 2,918 Colombian pesos to the USD exchange rate in this post. The exchange rate fluctuates daily and has ranged from 2,851 to 3,118 over the past month.)

El Poblado Apartments

El Poblado is the most popular neighborhood for foreigners living in or visiting Medellín. It is the most upscale neighborhood in the city. It’s also where the most hotels and furnished apartments catering to foreigners are located.

El Poblado is primarily an Estrato 6 neighborhood with about 74 percent of the households rated at estrato 6. It is also where the most expensive real estate and most expensive apartment rentals in the city are located.

I lived for over a month over six years ago in a furnished apartment in El Poblado during an early trial of living in Medellín.

I quickly determined that El Poblado wasn’t for me. I prefer to live in a neighborhood that has a lower cost of living and isn’t as westernized.

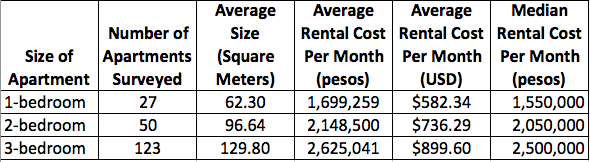

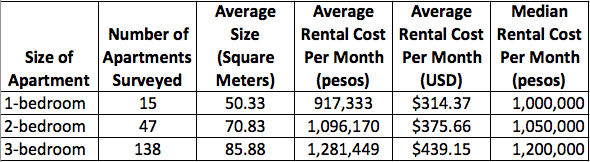

El Poblado survey of 200 apartment rentals results:

- 27 apartments were 1-bedroom or studios ranging in size from 38 to 100 square meters with rents ranging from 1.05 million to 2.6 million pesos per month.

- 50 apartments were 2-bedroom apartments ranging in size from 50 to 140 square meters with rents ranging from 1.3 million to 3.0 million pesos per month.

- 123 apartments were 3-bedroom apartments ranging in size from 70 to 220 square meters with rents ranging from 1.25 million to 6.2 million pesos per month.

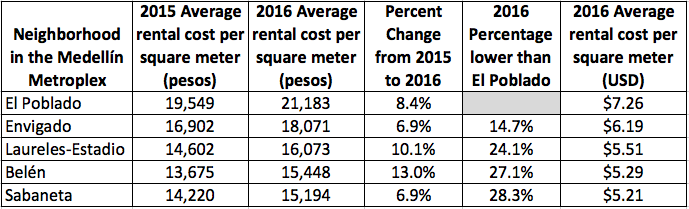

- The average rental cost per square meter of the 200 apartments in El Poblado was 21,183 pesos per month per square meter.

- Surprisingly 16 percent of the 200 apartments surveyed in the ritziest neighborhood of El Poblado did not have hot water and 10 of those with hot water only had electric hot water in the shower(s).

- 8.5 percent of the 200 apartments surveyed in El Poblado didn’t have a 24/7 porteria.

Envigado Apartments

Envigado is a popular neighborhood for foreigners living in Medellín. It is less commercial than El Poblado and is located directly south from El Poblado.

Envigado has many areas with tree-lined streets and fewer high-rise apartments than are found in El Poblado.

Envigado is more of a working-class community with 96 percent of housing in estrato 2 to 5 and only 4 percent in estrato 1 or 6.

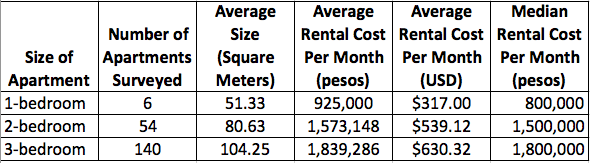

Envigado survey of 200 apartment rentals results:

- Only six of the apartments surveyed were 1-bedroom or studios ranging in size from 35 to 80 square meters with rents ranging from 600,000 to 1.8 million pesos per month.

- 54 apartments were 2-bedroom apartments ranging in size from 58 to 182 square meters with rents ranging from 800,000 to 3.3 million pesos per month.

- 140 apartments were 3-bedroom apartment ranging in size from 60 to 200 square meters with rents ranging from 600,000 to 3.8 million pesos per month.

- The average rental cost per square meter of the 200 apartments surveyed in Envigado was 18,071 pesos per month per square meter, which means Envigado apartment rentals are 14.7 percent cheaper on average than in El Poblado for similar size apartments.

- 18.5 percent of the apartments in Envigado did not have hot water and none of these only had electric hot water in the shower(s).

- 15 percent of the 200 apartments surveyed in Envigado didn’t have a 24/7 porteria.

Laureles-Estadio Apartments

Laureles-Estadio is another popular neighborhood for foreigners living in Medellín. Laureles is primarily a residential neighborhood. It has many areas with tree-lined streets and fewer high-rise apartments than are found in El Poblado.

The first unfurnished apartment I rented in Medellín was located in Estadio. Laureles-Estadio is primarily an estrato 4/5 neighborhood with 99 percent of the households rated at estrato 4 or 5.

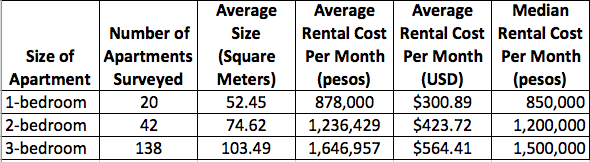

Laureles-Estadio survey of 200 apartment rentals results:

- 20 apartments were 1-bedroom or studios ranging in size from 38 to 80 square meters with rents ranging from 600,000 to 1.2 million pesos per month.

- 42 apartments were 2-bedroom apartments ranging in size from 55 to 140 square meters with rents ranging from 700,000 to 2.0 million pesos per month.

- 138 apartments were 3-bedroom apartment ranging in size from 60 to 185 square meters with rents ranging from 1.0 million to 3.2 million pesos per month.

- The average rental cost per square meter of the 200 apartments in Laureles-Estadio was 16,073 pesos per month per square meter, which means Laureles-Estadio apartment rentals are 24.1 percent cheaper on average than in El Poblado for similar-sized apartments.

- 35 percent of the 200 apartments surveyed in Laureles-Estadio did not have hot water and three with hot water only had electric hot water in the shower(s).

- 65.5 percent of the 200 apartments surveyed in Laureles-Estadio didn’t have a 24/7 porteria. A high percentage of the buildings in Laureles-Estadio are not high-rises so they don’t normally have 24/7 porterias.

Belén Apartments

Belén is a neighborhood that has been increasing in popularity for foreigners living in Medellín. Belén is the comuna where I lived for over three years in three different barrios (Fatima, Loma de Los Bernal and Los Alpes)

Belén is more of a working-class community with 98 percent of the housing in estrato 2 to 5 and only 2 percent in estrato 1.

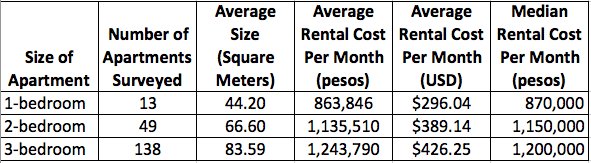

Belén survey of 200 apartment rentals results:

- 13 the apartments surveyed were 1-bedroom or studios ranging in size from 32 to 51 square meters with rents ranging from 650,000 to 1.1 million pesos per month.

- 49 apartments were 2-bedroom apartments ranging in size from 47 to 100 square meters with rents ranging from 840,000 to 1.55 million pesos per month.

- 138 apartments were 3-bedroom apartment ranging in size from 57 to 135 square meters with rents ranging from 820,000 to 2.3 million pesos per month.

- The average rental cost per square meter of the 200 apartments in Belén was 15,448 pesos per month per square meter, which means Belén apartment rentals are 27.1 percent cheaper on average than in El Poblado for similar size apartments.

- 12 percent of the 200 apartments in Belén did not have hot water and two of these only had electric hot water in the shower(s).

- 23.5 percent of the 200 apartments surveyed in Belén didn’t have a 24/7 porteria.

Sabaneta Apartments

Sabaneta is a municipality located directly south of Envigado. It is an area that has been booming with developers building many apartment buildings over the past few years.

Sabaneta is becoming increasingly popular with foreigners looking for an alternative that can be cheaper than El Poblado and Envigado.

My current apartment in Medellín is located in Sabaneta. Since I have lived in Sabaneta for over a year I hear English more and more around town as more foreigners discover the area.

Sabaneta is more of a working-class community with 98 percent of housing in estrato 2 to 4 and only 2 percent in estrato 1, 5 or 6.

Sabaneta survey of 200 apartment rentals results:

- 15 of the apartments surveyed were 1-bedroom or studios ranging in size from 34 to 68 square meters with rents ranging from 650,000 to 1.3 million pesos per month.

- 47 apartments were 2-bedroom apartments ranging in size from 55 to 126 square meters with rents ranging from 700,000 to 1.7 million pesos per month.

- 138 apartments were 3-bedroom apartment range in size from 60 to 207 square meters with rents ranging from 750,000 to 2.5 million pesos per month.

- The average rental cost per square meter of the 200 apartments in Sabaneta was 15,194 pesos per month per square meter, which means Sabaneta apartment rentals are 28.3 percent cheaper on average than in El Poblado for similar size apartments.

- 12.5 percent of the 200 apartments in Sabaneta did not have hot water and none of these only had electric hot water in the shower(s).

- 14.5 percent of the 200 apartments surveyed in Sabaneta didn’t have a 24/7 porteria.

Avoiding Paying Gringo Rental Costs in Medellín

It is very important to understand the market rental prices when looking for an apartment in Medellín. This is to make sure you aren’t taken advantage of by real estate agents and owners.

While I was living in Belén I met one expat living nearby that was paying about 70 percent higher rent. This was for a much smaller place without the view I had. I suspect this was the result of a real estate agent taking advantage of an expat not knowing the market prices.

When you lease from a real estate agency in Colombia you sign a contract with the agency. The agency has a separate contract with the apartment owner. The difference between the contracts is the “commission”.

If an agent sees someone that is not knowledgeable about the market it’s easy to jack up the price to the tenant and pocket the difference. So this article should help give a general idea of the current unfurnished rental prices in several areas in Medellín.

I also recommend looking at the Espacio Urbano website. This Spanish-language website is where most real estate firms in Medellín post apartment rental and sales listings. It is an invaluable website to help understand market prices.

Recently on International Living’s website a post about Medellín discussed an expat’s experience in renting an apartment in the Conquistadores barrio, which is located in Laureles.

The post says that the expat was paying $1,000 per month to rent a three-bedroom apartment. But if you look above at three-bedroom apartment prices in Laureles, you’ll find they should rent for less.

During our survey we didn’t find any apartments in Conquistadores renting for a price as high as $1,000. That is above the market price in the area.

I also read a recent report by Live & Invest Overseas, which claimed that an “unfurnished, two-bedroom, comfortable apartment in El Poblado or other expat-popular neighborhood” costs 3 million pesos per month to rent.

However, if you look at the survey results above, the average two-bedroom apartment in El Poblado actually rents for only 2,148,500 pesos per month or 2,050,00 pesos per month as a median. In fact, in our survey we only found one two-bedroom apartment renting for 3 million pesos in El Poblado.

The other 49 two-bedroom apartments in El Poblado we surveyed were all lower priced than 3 million pesos. So the actual average and median market price in El Poblado is much lower.

Other neighborhoods in Medellín popular with expats like Laureles-Estadio, Envigado, Belén and Sabaneta have even cheaper rental apartments as seen above.

Rent versus Buy?

If you are planning to move to Medellín from another country, I recommend not jumping right into buying or renting an unfurnished apartment.

First rent a furnished apartment for at least a month or more as I originally did to make sure Medellín is right for you. This will also give you the time and opportunity to explore the city to find which neighborhood(s) you would like to live in. However, even after deciding that you want to live longer-term in Medellín, buying may not be the best option for everyone.

In our study of the rental prices in Medellín, we saw many unfurnished apartments that rent for a year for only 5-8 percent of the purchase price to buy the apartment.

When determining if renting or buying is the better option, I suggest using a rent-versus-buy calculator like this one from New York Times.

Renting may ultimately be lower cost than buying if you factor in all the variables and costs including opportunity cost. Also if you buy you will be responsible for ongoing property taxes, maintenance and administration fees. The owner normally pays these costs for a rental property.

For my situation, with rents being so cheap in Medellín, renting for me is lower cost than buying over a 5-year, 10-year, or even a 20-year period.

Also with renting I have much more flexibility and can easily move to another neighborhood by choice, which I have already done three times. But to “each his own”, some prefer buying regardless.

The Bottom Line

If you want to save on unfurnished apartment rental costs in Medellín, our 2016 survey of unfurnished apartments demonstrates that you can save an average of 24-28 percent by living in Laureles-Estadio, Belén or Sabaneta instead of living in a similar sized apartment in El Poblado. If you select Envigado, you will only save an average of 14.7 percent compared to the apartment rental costs in El Poblado.

Our survey results also show that compared to last year the average rental price per square meter in terms of Colombian pesos has increased in all five neighborhoods in 2016.

In Colombia landlords are legally able to raise rent at renewal by no more than the inflation rate for the prior year. Inflation last year in Colombia was 6.77 percent, which was a seven-year high. Landlords can increase rent by no more than that percentage at renewal time this year.

However based on our survey, in some areas the average market rental price per square meter appears to have increased by much more than 6.77 percent as owners respond to demand.

A recent article in El Colombiano newspaper indicated that Laureles was the most popular apartment rental area in Medellín with the most space leased in the first half of the year.

It only takes on average three months for an owner to rent an unfurnished apartment in Laureles. In comparison, in pricey El Poblado it takes on average 11 months for an owner to rent an unfurnished apartment.

In popular areas like Laureles and Belén that traditionally have had lower rental prices, the market price looks to have increased faster than inflation. This is due to demand.

According to Lonja de Propiedad Raíz in the first half of the year, 32.3% of unfurnished apartment square meters leased in Medellín were in Laureles/Estadio and 19.7% were in Belén.

Avoiding Rental Price Increases

Even with owners being able to raise rents by the inflation rate in Colombia this is still negotiable in my experience. In my five apartment lease renewals in Medellín over the past six years I haven’t experienced a rent increase.

In fact, for two renewals I was able to negotiate a lower price. One year I was able to negotiate a lower monthly price by agreeing to a longer term and paying in advance.

My latest lease renewal this year was also at a lower price as I now rent directly from the owner instead of through an agent so I saved money even after factoring in inflation. The typical real estate agent commission for rentals typically runs between 7-10 percent.

The rental market is still competitive in Medellín. So you could threaten to move, particularly in El Poblado where it takes a long time on average for an owner to lease an unfurnished apartment. Plus the cost of moving can be quite low.

The owner may not want to lose a tenant as it may take a long time to find a replacement. I met an expat in El Poblado who did this recently. He threatened to move and essentially negotiated a lower rent increase for his renewal as a result.

It is also important to note that over the last two years, the exchange rate has been volatile and beneficial if you have U.S. dollars (USD), which has dropped the cost of renting an apartment in Medellín substantially over the past two years in terms of USD.

Nice article. I have been living here in Medellin for two months. As a tourist there is so much hassle to rent an apt. So i looked around on spanish websites for renting a room. found a nice private room in a house with two laid back guys from Venezuela. no utilities, use of kitchen. nice roof and living área with hammock. For only 5ook pesos. no utilities and wi fi and tv included. Near Floresta park. Near metro great shopping nearby. so one can live cheaply here. Note a friend said to look for websites in Spanish. thus avoid all the poblado expensive places. I speak Spanish and that was a great tip

Thanks for you input too. I speak mediocre amount of spanish. Living in Wisconsin at present. Really want to go live there. Am 67 and time is running out. So, no internet where you live? And many thanks to Jeff for such excellent coverage.

Hello, Frank! How come you think, that your time is running out? I am 74 and very active in sports and gym, enjoying long walks to mountains and also running. I came here to test living with my 52 yrs Colombian girlfriend and we have good times together, singing karaoke and walking in the town. In fact, I am in the process of searching a new wife for me, as my wife passed away 2015 and definitely I want a Latin woman. I lived previously in Ecuador over a year with another lovely woman, also aged 50, but our temperaments did not fit well enough, both boiling over easily. Still friends in Facebook.

Living in Copacabana bit north from the city is for me better, as air pollution levels here are much lower than in the low areas of the city (I have an app in my mobile showing sensor readings on all measuring points at any moment. I really recommend this app! ).

Life is what you make of it! Take the flight to Colombia!

I find it amazing that Jeff and his wife would give so freely of their time and energy to help those wanting to get an unbiased feel for the apartment market here.

Many thanks.

Thanks so much for all of this! My question- right now we rent from an agency, we have easy access to the owner (portero). Is it bad business to try and rent from the owner rather than agency? I saw you got a lower price by doing that, or was I misreading?

Thanks!

Yes I was able to get a lower price this year when I renewed by renting directly from the owner.

I had rented from an agency for over five years but I started having problems early this year with the agency so I didn’t want to use the agency anymore. My apartment owner also had problems with the same agency. The owner contacted me early this year and told me he wanted to deal directly with me and no longer work with the agency. I informed the agency in writing three months before my lease term was up that I didn’t want to renew with the agency, per the terms of the lease. So this was a win-win situation that worked out since the owner and I both didn’t want to use the agency anymore.

I negotiated directly with the owner and for the renewal this year he increased rent to be what the agency was paying him for rent with an inflation rate increase of 6.77% as permitted by law. But this was still somewhat less than I was paying last year by cutting out the agency middleman commission. I also negotiated with the owner to pay in advance for an entire year for an even lower price.

Going forward I only plan to rent from owners since I have a long history of renting and the rental price I negotiate can be lower since no agency commission is involved.

Is it true that the owner pays taxes on the entire amount of rent he receives thru an agency; therefore, when you pay the owner directly at a lower rate, he pays taxes on the lower amount only? This way, everyone is happy except the agency and they are not happy no matter what.

The owner can essentially receive the same rent regardless if he rents through a real estate agency or directly to a tenant. The way it works with a real estate agency in Colombia is that the agency has a rental contract with the owner and separate rental contract with the tenant. The agency pockets the difference between the two contracts that in my experience is 7-10 percent. The tenant wins by renting directly with an owner, the agency loses and the owner experiences no real difference.

Contact a local tax accountant to find out the details about tax-ability of rental income for Colombia. The owner likely can deduct expenses like administration fees (HOA-like fees in Colombia that the owner normally pays), property taxes, maintenance expenses as well as interest on mortgage payments if the owner has a mortgage.

You are correct about foreigners in Envigado. I purchased pre construction last year and have seen a big jump in Americans,

something I have been trying to avoid( if I want to hang with Americans I would stay here).

Colombian women have told me they avoid bars in Envigado because too many gringos.

My experience traveling to many places and living in Europe is more Americans= higher prices and dealing with drunk Americans singing “Born in the USA ” Or yelling “We are the best.”

This is an impressive presentation of data, and timely, as I presently am pounding the pavement around the Primer y Segundo Parque areas looking for a 1-bedroom or studio in a newer high rise with 24/7 security. I just try to contact owners any way I can. This area, man it’s like 99.9% occupied! I guess everybody wants to live here.

This article fails to mention that any foreigner who wants to achieve these prices will need a Colombian co-signer. It is extremely difficult to impossible for a foreigner to walk into an apartment for rent and just start paying rent without a citizen who owns property or has a large monthly cash flow into a Colombian bank account to co-sign for them.

Not true that you need a Colombian co-signer (known as fiador). I have been renting without a fiador for over six years. Read this post about overcoming the fiador requirement – http://medellinliving.com/apartment-rental-guide-fiador/.

If you rent directly from an owner you can overcome the fiador requirement. I have met many foreigners renting from owners that didn’t need a fiador. I currently rent from an owner and I didn’t need a fiador. There are also some real estate agents that will rent without a fiador if you pay in advance. I rented from real estate agents for five years without a fiador but it can be challenging to find a real estate agent that won’t require a fiador.

Jeff, as usual good effort, but I agree with Jose. It is extremely difficult for foreigners to rent an apartment in Medellin without a fiador. I know it is possible, but in my experience the agent often requires an up front security deposit of between 6 – 10 months rent!!!! This is ‘supposedly’ refundable at the end of the term and is in addition to paying your monthly rent. Personally, I think that agents are unreliable and untrustworthy – they are best avoided at all costs. I agree, it’s always best to rent directly with an owner, however it’s really, really tough to find an owner directly. Something like 98% of all rental properties on the market are with an agent!.

I was very lucky because I managed to find an owner directly for my brand new 3 bed apartment in Poblado about a year ago. I didn’t need to mess about with a fiador, rip-off security deposit, advance rent payments or inflated gringo prices…but like I said I was very lucky!!!!

IMHO run from any agent that requires a security deposit as you may not get your money back. I met two expats that paid rental deposits that never saw the money again when they moved. I understand that legally deposits are not supposed to be included in rental contracts but they can be something separate. I never had to pay deposits when renting from real estate agents but I had to pay in advance since I didn’t have a fiador.

True that almost all rentals are with real estate agencies but you can bypass the agents if you can find out the owner’s name and phone number but this requires decent Spanish as most owners don’t speak much English. I happened to luck out as my apartment owner speaks fluent English but I also speak Spanish at the intermediate level.

It is relatively easy to find apartment owners in my experience, sweet talk the porterias (doormen) or you may have to give them a few thousand pesos. My Colombian wife has no problem getting apartment owner names and numbers from porterias for any apartments with rental signs in the windows. For buildings without porterias talk to the next door neighbors.

The bottom line is the fiador (cosigner) requirement is a challenge to renting unfurnished apartments in Colombia but it can be overcome. I have met many expats that have successfully rented unfurnished apartments without fiadors.

Hey Jeff,

I understand that the multiple months security deposit is a requirement demanded by the insurance companies that many agents use… The process goes something like this…you submit your application to the agent along with supporting documents and they send it off to an insurance company. Once the insurance company conducts a ‘risk assessment’ they advise whether it is OK to proceed as is, or several months security is required… Supposedly, the money is held securely by the insurance company not the agent… In any case, this is total foolishness to me and I would never proceed on that basis. However, I know many others who have had no choice but to pay huge upfront deposits.

Clearly, we’ve both been successful renting in Medellin without a fiador, so we know it is possible. However, the simple reality is that for the vast majority of foreigners, it will be excruciatingly difficult to find owners to rent from directly. I believe this point should be clear in your articles. I know It can be both futile and soul destroying to pound the streets, walking from building to building asking porterias for owners details for any vacant apartment. In my experience you’re going to burn a lot of shoe leather that way and uncover a lot of false positives. Surely, there must be a better way in 2016…! Perhaps, you could issue an update to your rental guide with some viable alternatives. What do you think?

Hi Robz,

Yes it’s probably worthwhile for me to do an update of my rental guide and also look at the insurance options. I think it would be worthwhile for me to also interview several expats renting to find out their experiences and how they overcame the fiador requirement.

For my first and second apartment rentals I burned a lot of shoe leather and it was a completely frustrating experience. After those experiences it became pretty easy.

Unfortunately renting unfurnished apartments can be a lot more difficult than it should be. If you speak pretty fluent Spanish or use someone bilingual to help it can be much easier. Clearly there is a business opportunity here for someone to help expats. But the commissions are pretty low for rentals so a difficult business.

My experience with Americans abroad has been different than what Mike, above, describes. Having travelled or lived in 17 countries I have seen many delightful conversations between strangers on the road ruined by Americans loudly proclaiming their distaste for and dislike of their own country. On those occasions I felt that it was such a shame to see a promising gathering break up because of politics.

Anyway, I had read and profited greatly from Jeff’s previous series of articles on apartment hunting. I am set up in nice digs at a reasonable price.

geoffrey, can you fill us in a little on how you were able to find your “nice digs” and what you pay in rent, and in which barrio

?

Great article.

I find it interesting that in El Poblado it takes on average 11 months for an owner to rent an unfurnished apartment.

Why is that?

Are the locals more interested in buying vs renting?

Why does it take 11 months to rent an unfurnished apartment in El Poblado? It’s likely due to the high rental prices there compared to other areas in the city plus the higher cost of living in El Poblado. Most Colombians in the city can’t afford to live in El Poblado. The wealthy live in El Poblado.

Most of El Poblado is rated as estrato 6, which is a wealthy area in Colombia. Along with higher costs of renting or buying property, costs for everything else are also higher. For example, estrato 6 households pay more for utilities to subsidize the lower estratos. Estrato 6 in El Poblado only represents about 3% of the households in Medellín. The majority of households (79%) in Medellín are rated as estrato 1-3 neighborhoods.

Laureles and Belén are popular with Colombians because they are more upper middle class/middle class neighborhoods with lower costs of living than found in El Poblado.

In February, I intend to stay with a friend in La Frontera while I research possible areas to live, Sabaneta, Aves Maria is a possibility. My monthly Social Security meets the requirement for a Retirement Visa—will I still need a fiador. For my Visa, I will need an apostille, What is that for, AND, what do I need to present to the Columbian Embassy (I plan to be in MD the end of October so may be able to go to the Embassy located in Washington, D.C.). However, since I do not plan to actually be in Medellin until next year, will the apostille still be valid? You see, your first apostille is free in D.C. Thanks for sharing your experiences.

Hi Anna,

You could get a visa at the Colombian embassy. Colombia likes to see documents for visas that are dated no more than 3 months old. The apostille is used to authenticate documents for use in another country.

It is possible to rent an apartment without a fiador. But you’ll have to find an owner or real estate agent willing to do this. I have had success in renting without a fiador for over six years and I have met many expats that have had success as well. If you don’t speak much Spanish I recommend finding someone bilingual to help you.

While I commend the amount of effort that went into this – and it’s usefulness I do think that some balance is needed on your findings.

On the need for a Fiador I think other comments that avoiding this as a foreigner isn’t easy are correct. You managed it, but then you’ve a Colombian wife. That I think might have been an important element for landlords.

Firstly let’s talk about Poblado. ‘Westernized’ – what does that mean? The lowest crime rates, the best restaurants in town, better fitted out apartments with better amenities and security? If you were to ask most locals which district they’d like to live in (money allowing); most I think would plump for Poblado. Do they think it’s ‘westernized or do they just think it’s the best neighborhood in town?

Poblado is the most prosperous neighborhood in the city – but how ‘wealthy’ are your neighbors there? Well, there’s a fair smattering of well to do retired people with family money, but the majority are your regular couples, both working with kids – the Upper Middle Class that you suggest focus on Laureles and Belen. How rich are those couples? Well if they’re professionals they’re probably earning no more than $30,000 between them. So, let’s understand what the financial situation of the residents are; they’re not Russian Oil barons. Wealthy in Colombia is a relative term.

On ‘everything’ being more expensive, that’s not exactly true either. That utilities subsidy you mention isn’t a big deal and going to the supermarket isn’t more expensive – there’s just generally more choice.

One of the key take aways from your survey could be that the rent for a place in the best zone in the city isn’t that dramatically different to others. 15% over the second placed district (and a district where it’s arguable to say that growth is creating huge issues in things like traffic) and 30% over that rated 5th. How many other cities would that be true of? It’s actually less of a margin that one might expect.

Your data, while nicely collected might also be flawed with some of the El Poblado data. There are a significant number of high end apartments in the zone which in your text you hint at. The upper end of your El Poblado data was over COP 6 million a month.Those ‘ultra’ expensive properties are going to skew your data or at least your averages. Perhaps next time it might make more sense to use the Median rather than the Average? It still won’t stop Poblado being more expensive but it might lessen the differential.

Now let’s turn to renting against buying. Again personal preference but there are so many wild cards here that trying to assess this with any certainty is difficult. As you say at the end of the article the exchange rate is one of the biggest problems and one that the NY Times model isn’t really going to capture. Most people who come here have offshore income which they need to change into Pesos. At the moment the Peso is historically weak, although it’s recently strengthened quite a lot. So in planning you don’t know what your rent is going to be in Peso terms (because of the inflation effect) and you don’t know the dollar cost of those Pesos because you don’t know the exchange rate. There’s also the basic truism. If I buy an apartment for 100 and you rent the same apartment for 5 a year for 10 years you haven’t ‘saved’ 50. I’ve still got the asset and you’ve just spent cash.

You also stated that the inflation level you show is a high. That was true – last year – but this year short of some economic miracle inflation is going to be over eight percent – and that again is going to leach back into rental prices in 2017.

There’s actually a good case for buyers to purchase now. Interest rates here are really high (say 13-15% on a Mortgage) which combined with inflation is making it difficult for local people to enter the housing market, or for more expensive properties to be sold. So there’s a fair amount of inventory (selling a property can take 12 months or so) so combined with what isn’t a bad exchange rate this might be a reasonable time to buy. If you think about the length of time that it takes to sell a property – and the level of inflation most properties – if they’re sold at their original price actually trade at a discount.

Lastly with interest rates at their current level and the inability for people to buy houses (remembering that this is a young population with lots of couples at child rearing ages) there’s going to be continued pressure on rentals going forward.

Regarding the need for a fiador, I rented without a fiador while I was single for several years before I got married in Colombia. I know several single expats that have successfully rented without fiadors.

I agree that with the improved exchange rate it can be a good time to buy. But buying is not for everyone. I have met some expats that bought property several years ago in Medellín that ended up leaving but I know a few were stuck with properties they had difficulty selling and at least one had to turn into a rental. And some sold with a USD loss due the more recent exchange rates. I would estimate that as many as a third of expats that move here to Medellín leave in 3-4 years or less based on well over 80 expats I have met over the past several years. Over a third of the expats living in Medellín I have met over the past six years are no longer living in Medellín. Most that left returned home and some moved to other cities in Colombia.

Regarding renting vs. buying — While there is inflation to be factored in for renting, this can be offset by the high CDT interest rates paid by banks in Colombia. I transferred money to Colombia when the exchange rate was over 3,400 pesos to the USD that is sufficient to pay over five years of rent that I put in CDTs earning over 8%. I doubt inflation is going to continue to be as high as this year or last year in Colombia. So I have essentially locked in my rental price in terms of USD for a long time.

With buying there is opportunity cost. What else could you do with the money? If you buy an apartment for 100, and I rent for 5 — I can invest the 95 I didn’t spend to buy a property. I invested in some CDTs in Colombia earning an average of over 8% early this year to hedge the inflation risk for my future rent payments and lock in my exchange rate. I Invested some USD wisely 5 years that has more than doubled since I invested. If I had invested that money 5 years ago in property in Colombia I probably would have lost money in terms of USD considering the exchange was about 1,800 COP to the USD 5 years ago. To me a property that I live in is not a liquid investment – I would rather invest my money in something liquid. Also not everyone has sufficient cash to buy a property and it’s very difficult for an expat to get a mortgage in Colombia. Plus there is clearly exchange rate risk when buying property in Colombia as anyone that bought a few years ago in Colombia has experienced.

By renting we can easily pick up and move if someone builds a monstrosity apartment blocking our view; if the crime rate skyrocketed in the building or barrio; if we decided to move to another neighborhood, another city in Colombia or another country; or if Colombia elects a new president that turns the economy into more like Argentina’s or Venezuela’s. With renting you have much more flexibility.

The bottom line is that with the improved exchange rate it may be a good time to buy property in Colombia but buying isn’t for everyone. I have met many expats that rent.

I think that we both agree that buying isn’t for everyone – and that some period of renting in the city makes sense before making the plunge. However your article does have a strong bias towards renting – and the converse is true – renting is not for everyone.

It is also true that in $ terms people have lost money on property investments in the city – the big move in the exchange rate over the past twelve months has put many people ‘under water’. However your timing – buying Pesos when the market was over 3.400 isn’t something we all have the skill to execute. The peso was over 3,400 for only a couple of days, reaching a peak of 3,414 on February 16th. Pulling the trigger at that sort of levels and getting execution above 3.,400 from a bank isn’t something the majority of us mortals are going to be able to achieve. And I used to be in the business.

ON CDTs I too have them and for people in the US used to extremely low interest rates the 8.5% rates for 6 month deposit sound attractive. However, CDTs aren’t proving to be a complete hedge. Firstly the rate trends just around the annual inflation rate and secondly those aren’t tax free bonds. Your effective yield, if you’re a resident and subject to Colombian taxation is more like 6%. In reality those investments aren’t making you money – you’re actually losing ground. It’s true that you’re hedging some of the risk – but it’s not a great financial move – although given the limited instruments available locally it is not an illogical strategy.

On getting a mortgage it’s very true that it really isn’t an option for most expats. Even if it was the interest rates would make it unattractive. But equally the prices of houses here usually mean that people relocating here, in particular if they’re retiring and selling up in the US, don’t require funding. Even in ‘rich’ Poblado there are properties for $100,000 or less. Some of the best properties are priced at $250,000. Very high end properties are $300,000. By US, or European benchmarks that is cheap real estate. The reality is that if you buy you’re likely to have a nicer apartment than if you rent (and in many cases a nicer property than you had in the US). Taking a personal example we’ve been considering selling our apartment or renting it out. It’s valued at just under $300,000 – and the guide line we’ve been given for short-medium term furnished rentals is COP 8 million a month.I’d suggest that anyone who was interested in the property would be advised to buy it rather than rent it. In reality good apartments are better buys than rents. As a further point local taxes on property owned are a fraction of those in the US – another benefit – and a big factor for someone like me who had property taxes of $14k a year in the US.

I will agree that there are too many ex pats who are leaving after having poor experiences. In some cases that may well be investments they’ve made that haven’t worked out. Equally I think that for some people they’ve been disappointed with Medellin. I think there are case where that’s because they’ve tried to move to the city too cheaply – attracted by the thought of a rental in a cheaper and less ‘international’ neighborhoods. Ultimately the gap between the life that they left and life in Medellin has been wider than they’d anticipated. Living in the best area you can afford at least limits some of that risk. Living as a local ‘among the working people’ suggests a certain charm but the reality is sometimes a shock to the average retiree.

I will agree that the property market here isn’t liquid – a situation exacerbated by the current interest rates. But equally anyone who retires to Colombia (or anywhere) and then decides it’s not for them is going to face significant cost and logistical issues in selling up. I don’t think Medellin is unique in that.

You may have the opportunity to move on if someone builds a monstrosity next to you. On my side, if your economic prediction of falling inflation (and therefore interest rates) is correct I’m likely to have some real estate appreciation that you as a renter won’t enjoy.

In reality neither of us is completely right or wrong and only time will tell which the best economic solution is. But the concepts that ‘renting is a better deal’ and that ‘Poblado is expensive and westernized’ are both overly simplistic. You’ve clearly made excellent decisions – such as the exchange into Pesos at the market high. For the rest of us life involves a little more juggling.

Your data on rentals is useful. But there’s nothing in the data – as you’ve excluded information about property prices – that realistically justifies your proposition that renting is a better strategy. Even in the comparisons between the different areas there is a whole set of criteria that you’re missing to make complete assessment of value. Is a two bedroom apartment the same in two different zones? The same in five zones? The same neighbors? The same safety at night? The zones that you review have significant differences in quality of life even within the zones themselves. What you have done is present a commendable set of data to provide some benchmarks about what different pricing levels between areas. However, it’s a leap to suggest that the data represents some value proposition given all of the subjective factors that exist with real estate in any location.

The whole purpose of spending a significant amount of my time and my wife’s time researching the rental market in Medellín and writing this article was to help expats so they aren’t taken advantage of. I have personally seen several expats pay too much for rent. Note we received almost no compensation for doing this.

The big move in the Colombian peso exchange rate started back in mid-2014, over two years ago. So anyone that bought property in mid-2014 or several years earlier in Medellín has likely lost money in terms of USD unless it was an older property that was a refurbishment property.

Here is my actual buy versus rent numbers over the past five years to help demonstrate the currency risk and opportunity cost involved and how to do a buy versus rent analysis. This is one very specific example of why buying may not be the right choice.

– Assume I would have bought five years ago after living here a year when the exchange rate was 1,800 COP to the USD.

– Assume rental price of 1,200,000 COP per month and purchase price of 288 million COP (the property I was renting 5 years ago)

– Assume no rental increases and no security deposit (which is what I actually experienced)

– Assume I moved to a nicer place in year 6, which increased rental price to 1,300,000 COP per month (which actually happened)

– Assume property market price in COP increased by 6% per year

– Assume property taxes of 1%, only paid when buying (owner pays this for a rental)

– Assume monthly administration fees of 220,000 COP that increases annually by the prior year inflation, which is only paid when buying (owner pays this for a rental)

– Assume closing costs of 2% and buy with cash

FOR BUYING

– Purchase price would have been about $163,200 USD including closing costs

– Property taxes paid over five years would have been about $6,800 USD

– Administration fees paid for five years would have been about $6,500 USD

So I would have spent a total of $175,500 USD and have a property now worth about $134,600 USD at the current exchange rate. Essentially I would have lost over $40,000 USD by buying. It also may take upwards of a year to sell a property in the pretty illiquid market. Note the loss would actually be more if I had included property insurance costs over five years.

FOR RENTING

– Paid rent over five years totaling about $33,200 USD out of my income

– Instead of paying cash to buy a property, invested about $150,000 USD in investments that have over doubled in value over five years

So I now have over $300,000 USD in a liquid investment and spent $33,200 USD on rent for a net of over $266,000 USD, which means I have about double compared to if I had bought property.

The bottom line is that since I invested the purchase price instead of buying and earned a good rate of return on my investments renting was the better move. When I made this rental decision five years ago I assumed a much lower return on my investments than I actually received. I also obviously couldn’t project the huge change in the COP exchange rate.

It remains to be seen if renting will be the right strategy over the next five years. I don’t know if my investments will do as well and no telling what the exchange rate will be in five years and no telling if the property market in Colombia will continue to increase each year. But I am already way ahead financially by renting.

With the peso exchange rate currently high compared to historical rates buying may now be a very good move for some people. I personally believe the best property investments in Medellín will be refurbishment properties as older properties are much cheaper than new properties. But we will continue to rent as we expect to move in less than five years.

Yes the effective interest rate on CDTs in Colombia after taxes is more like 6% but I don’t believe that inflation in Colombia is going to average 6% over the next five years – I suspect it will slowly trend downward to perhaps the longer term average of 3-4%. I also don’t believe the exchange rate will likely get back above 3,400 pesos to the USD.

Regarding the five different neighborhoods covered in this article – I have lived in four of the five and yes they are different. There is a wide range of types and qualities of properties in each area as demonstrated in the wide range of rental prices. Note we excluded properties in our survey that we thought were not appropriate for foreigners and those without hot water we included could have hot water easily added. There are tons of variables involved and I have lots of data including property pricing and crime rates by neighborhood that unfortunately I won’t be writing about on this site as it will take too much time.

One interesting statistic I’ll offer though is that reported crime in El Poblado is increasing, while in the rest of the city it’s decreasing. Robberies/thefts of people reported in the entire city of Medellín from January to May dropped 13% but were up 15% in El Poblado compared to this period a year ago. El Centro was the most common area for reported robberies followed by Laureles and then El Poblado.

My personal experience is the quality of life can be better for some people willing to embrace more of the Colombian culture in neighborhoods outside of El Poblado. Note the apartment in Sabaneta we are currently living in was new when we moved in and has all the amenities of a newer apartment in a newer building in El Poblado.

The problem is you are trying to make something sound very scientific when it isn’t. Doing a ‘look back’ scenario on how you made the right decision isn’t that difficult to do. Your scenario works a) because the exchange rate moved significantly and b) in the same period if you had investments in say the US they doubled – as the S&P did. It all works around the time period you choose for example. So someone who bought this year, when the Peso was really weak, is already 20% ahead – and using your example that’s probably ‘saved’ them 5 years of rent.

It’s fair to say that if the Peso declines in value (to any great extent) renting is likely to be cheaper. It terms of ‘having the cash and making better investments’ you can always lookback and find something that would have performed better than Real Estate in Medellin. In terms of Medellin real estate it’s true that the city isn’t super hot these days – and hasn’t been for a while, but have you looked at prices for fincas? They’ve gone through the roof – and in the right areas – probably beat your returns in the US over the past 5 years, even with the exchange rate move. The area out towards the airport is in some ways becoming the ‘new’ Poblado.

You don’t even touch the visa issue. You are married to a Colombian (as I am) so you qualify for a visa. For others wanting to come to Medellin that may not be so. If they’re retired they can of course apply for the Pensioners visa. But for someone who is maybe retiring early (which the cost of living in Medellin allows you to do) the Investors visa is a good way people can get a residency visa.

On refurbished properties (our apartment is one) although that’s been a big trend in other cities it’s still noticeably absent here. One, locals seem to prefer new builds and pay a significant premium for them. One element may be the builder provided financing. So refurbished apartments can be a good buy – in the right building – but they aren’t as easy to sell. My view of the what’s going to happen is more orientated around the city plan to develop the area down from Poblado Avenue to Industriales. There’s going to be a big focus there on a work/live ‘modern’ city environment with a lot of new apartment buildings going up. All of that is only going to reinforce the attraction of Poblado and the surrounding areas.

True that hindsight is 20/20 but my example in my above comment does demonstrate that renting can be lower cost than buying. In this case over a five year period renting was substantially cheaper due to inexpensive rents (~5% annually of the property cost), ability to invest money elsewhere for a higher return, the significant move in the exchange rate, plus no need as a renter to pay recurring ownership costs (property taxes, administration fees and property insurance).

It remains to be seen if renting will be the right strategy over the next five years.

The visa options have already been covered in several prior articles on this website.

Another point about buying property if you are married to a Colombian is that Colombia is a community property country. Assets acquired post marital union are most commonly divided “50/50” in Colombia. I met one expat that bought property that was burned by this as he didn’t realize that two years of cohabitation in Colombia represents a legal and defacto marital union. See: http://medellinliving.com/the-ultimate-guide-to-marriage-prenups-and-marriage-visas-in-colombia-3-real-examples/. His relationship didn’t work out and she went after her share of the property and got it.

Agreed. One solution (as in my case) is to have your wife be able to pay 50% of the purchase price.

On the visa I know it’s covered elsewhere, but purchasing property is one of the easiest ways of getting a residential visa so it should at least get a ‘tick’ for that over renting. People often complain that there’s no program for retirees coming to Colombia as there are in neighboring countries. For me the RE visa is in fact exactly that. Make a reasonable investment in property and you can live here.

Incidentally distribution of property, after the sad death of one partner, is an even more interesting subject in Colombia than distribution after divorce.

Very good point about the distribution of property after the sad death of one partner in Colombia. Funerals and inheritance laws in Colombia is a topic we should probably cover on this site. Inheritance laws in Colombia are definitely different than in the U.S.

Good Morning: I have a brand new 2 bedroom (90 meters) furnish apartment for rent in San Antonio De Pereira, a beautiful town near Medellin, San Antonio is famous for Colombian gastronomy and entertainment. My apartment has a vast view of the mountains and the town very close to mayor supermarkets and hospitals. The unit is located in the last floor and 12 stories up with a fitness center located in the roof top with a 360 city view. I want to lease it long term if possible( not used to deal with renters ) I live in Houston, please contact me at 832-382-7478 or e mail at dansupervisor@gmail.com

Gracias,

Dan Parra

I am a retired American who has been living in Mexico for most of the past 6 years. Have experienced much of the same expat issues discused in your informativel blog. Thinking of coming to Medelin for the winter months next year & of course need a furnished place to stay. It would be great if you added a Classified section with listings you had checked out. Perhaps the owners could pay a fee for the listing a la Craigslist.

P.S. I bought the Kindle edition of your book.

Jeff,

Great insight. Looking for suggestion. Currently in Medellin (Estadio area) for an additional 2 weeks. This is my third trip. I currently plan to return in a few months. I am looking for a place where I can rent (preferable furnish, but will entertain unfurnished also), for a minimum of

a year while I live, study Spanish and explore the country. I am walking the pavement in Estadio/Laureles, my preferred area, looking for apartment.

In your or readers experience if i can’t find the owner, is there a honest/reputable agent you would recommend to deal with or fluent Spanish speaker to assist ex pat in there search? This is for anyone reading this issue. FYI – I will be here for the April 2017 meeting.

Hi Ted,

Thanks. I used a real estate agent for five years but ran into problems with him and now rent directly from an owner. So I can’t recommend the agent I used before.

At our April Medellín Living meetup you may be able to find a recommended agent talking to other expats. Our April meetup will be on April 20 at 7pm at Delaire Sky Lounge in El Poblado. Details will be posted on the Medellín Living site early next week. Alan, one of the writers on the Medellín Living site, will be there and he lives in Laureles, so perhaps he’ll have a recommendation for you.

I had a place to rent pease contact me at dansupervisor@gmail.com